Did you know that over 33 million people in the United States rent cars each year? Whether you’re borrowing a car, renting a vehicle, or need protection for a specific event, temporary vehicle insurance can provide the necessary peace of mind for drivers who need short-term protection.

Temporary auto insurance coverage offers flexibility for drivers with changing needs. It’s a convenient solution for those who don’t require a long-term policy. In this section, we’ll explore the benefits and features of temporary insurance for car and discuss its importance in today’s fast-paced world.

Understanding Temporary Auto Insurance

Understanding the ins and outs of temporary auto insurance is crucial for making informed decisions about your car insurance needs. Temporary auto insurance, also known as short-term car insurance, provides flexible coverage for a limited period, typically ranging from a few days to a few months.

Definition and Basic Concepts

At its core, temporary auto insurance is designed to offer temporary coverage for auto insurance needs that aren’t met by traditional annual policies. It’s ideal for situations where you need to ensure you’re covered without committing to a full year.

Common Situations for Short-Term Car Insurance

There are several scenarios where opting for short-term car insurance makes sense. Two of the most common situations involve borrowing or lending vehicles and rental car alternatives.

Borrowing or Lending Vehicles

When you borrow or lend a vehicle, ensuring the driver has adequate insurance coverage is crucial. Short term auto insurance can provide the necessary protection for the duration the vehicle is in use. This type of insurance can be particularly useful when a friend or family member borrows your car for a short trip.

Rental Car Alternatives

For those renting a car, the rental company’s insurance options can be expensive. Temporary coverage for auto insurance can serve as a cost-effective alternative, providing peace of mind without the high costs associated with rental car insurance.

In summary, temporary auto insurance offers a practical solution for drivers with short-term needs. By understanding the definition, basic concepts, and common applications of short-term car insurance, you can make informed decisions about your insurance requirements.

Temporary Auto Insurance Coverage Options

Temporary auto insurance policies offer a variety of protection types to suit different situations. Whether you’re borrowing a car, test-driving a new vehicle, or simply need coverage for a short period, understanding your options is key.

Types of Protection Available

Temporary auto insurance typically includes several types of coverage. Liability coverage is usually mandatory and covers damages to others in an accident. You may also opt for collision coverage, which pays for damages to the vehicle you’re driving, or comprehensive coverage, which covers non-accident damages such as theft or vandalism.

Additionally, some policies may offer personal injury protection or uninsured/underinsured motorist coverage. The specific types of protection available can vary depending on the insurer and the policy.

Duration Flexibility

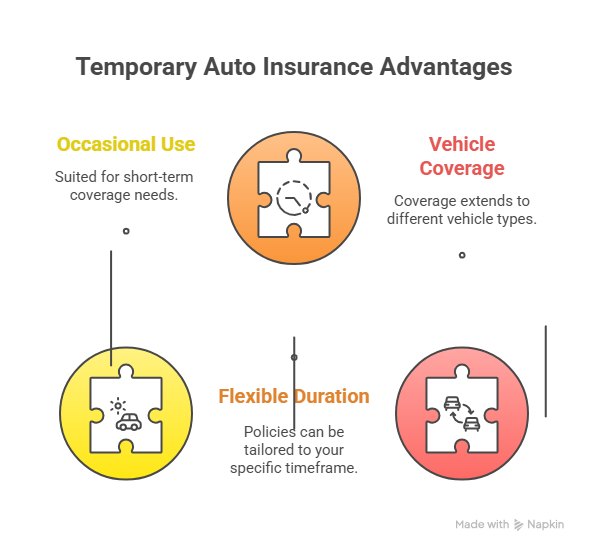

One of the significant advantages of temporary auto insurance is its flexibility in terms of duration. Policies can often be tailored to last from just a few days up to several months. This flexibility makes temporary auto insurance an ideal solution for short-term needs, such as when you’re visiting a friend and need to drive their car, or when you’ve rented a vehicle.

- Short-term policies for occasional use

- Flexible duration to fit your needs

- Coverage for various types of vehicles

Cost Factors and Pricing

The cost of temporary auto insurance is influenced by several factors, including the type of coverage chosen, the duration of the policy, and the driver’s history. Generally, the more comprehensive the coverage and the longer the policy duration, the higher the premium. However, temporary auto insurance is often more cost-effective than annual policies for short-term needs.

To get the best value, it’s essential to compare quotes from different insurers and consider factors such as deductibles and coverage limits. Some insurers may offer discounts for certain types of coverage or for bundling multiple policies.

Comparing Temporary vs. Traditional Auto Insurance

Understanding the nuances between temporary and traditional auto insurance is vital for making an informed decision. Both types of insurance have their advantages and disadvantages, which are discussed in detail below.

Coverage Differences and Limitations

Temporary auto insurance and traditional auto insurance differ significantly in terms of coverage duration and flexibility. Temporary vehicle insurance is designed for short-term use, typically ranging from a few days to a few months.

In contrast, traditional auto insurance provides long-term coverage, usually for a year or more. The coverage options for temporary auto insurance may be limited compared to traditional insurance. For instance, temporary insurance might not offer the same level of comprehensive coverage as traditional policies.

Price Comparison Analysis

The cost of temporary insurance for car can vary significantly from traditional auto insurance. Temporary insurance is often more cost-effective for short-term needs, as it only charges for the period of coverage.

| Insurance Type | Average Cost | Coverage Duration |

|---|---|---|

| Temporary Auto Insurance | $20-$50 per day | 1-90 days |

| Traditional Auto Insurance | $100-$200 per month | 1 year or more |

Eligibility Requirements

The eligibility requirements for temporary auto insurance and traditional auto insurance differ. For temporary insurance, the requirements are generally less stringent, focusing on the driver’s license and vehicle information.

- Valid driver’s license

- Vehicle registration

- Proof of identity

In contrast, traditional auto insurance requires more detailed information, including driving history and credit score. Understanding these requirements can help you choose the most suitable option for your needs.

Conclusion

Temporary auto insurance provides a convenient and flexible solution for drivers who need short-term coverage. Whether you’re borrowing a car, renting a vehicle, or require coverage for a specific event, temporary auto insurance can provide the protection you need.

With temporary coverage for auto insurance, you can enjoy the benefits of short term auto insurance without being locked into a long-term policy. This type of insurance is ideal for individuals who need coverage for a limited period.

By understanding the benefits and limitations of temporary auto insurance, you can make informed decisions about your insurance needs. Consider your options carefully and choose a policy that meets your requirements.

FAQ

What is temporary auto insurance, and how does it work?

Temporary auto insurance provides short-term coverage for vehicles, typically ranging from a few days to a few months. It works by offering flexibility and peace of mind for drivers who need protection for a limited period, such as when borrowing or renting a car.

How long can I purchase temporary car insurance for?

The duration of temporary car insurance varies, but it can range from a few days to several months. Some insurance providers offer flexible policies that can be tailored to your specific needs, including short term auto insurance and temporary coverage for auto insurance.

What types of protection are available with temporary auto insurance?

Temporary auto insurance offers various coverage options, including liability, collision, and comprehensive coverage. You can choose the types of protection that suit your needs, ensuring you have the right level of coverage for your temporary vehicle insurance.

How much does temporary auto insurance cost?

The cost of temporary auto insurance depends on several factors, including the duration of coverage, the type of vehicle, and your driving history. Insurance providers will assess these factors to determine your premium, so it’s essential to compare prices and find the best value for your temporary insurance for car.

Can I purchase temporary auto insurance if I don’t own the vehicle?

Yes, you can purchase temporary auto insurance even if you don’t own the vehicle. This is often the case when borrowing or renting a car, and temporary auto insurance can provide the necessary coverage for the duration of your use.

How does temporary auto insurance compare to traditional auto insurance?

Temporary auto insurance differs from traditional auto insurance in terms of its duration and flexibility. While traditional auto insurance provides long-term coverage, temporary auto insurance is designed for short-term needs, offering a more flexible solution for drivers who require temporary vehicle insurance.

What are the eligibility requirements for temporary auto insurance?

The eligibility requirements for temporary auto insurance vary among insurance providers. Typically, you’ll need to meet certain criteria, such as having a valid driver’s license and providing information about the vehicle, to qualify for temporary coverage for car insurance.

Can I cancel or modify my temporary auto insurance policy?

The flexibility to cancel or modify your temporary auto insurance policy depends on the insurance provider’s terms and conditions. Some providers may offer more flexibility than others, so it’s essential to review your policy details before purchasing temporary car insurance.