“The biggest risk is not taking any risk…” – Mark Zuckerberg. This quote resonates with vehicle owners in India who are increasingly faced with decisions that involve risk, such as choosing between SUVs and sedans. One crucial aspect of this decision is the cost of insurance.

When considering the purchase of a vehicle, understanding the insurance costs is as important as knowing the purchase price. Insurance costs can significantly impact the overall cost of ownership, and these costs can vary widely between different types of vehicles.

The debate about whether SUVs are more expensive to insure than sedans is ongoing. Factors such as vehicle type, driver behavior, and location play a significant role in determining insurance premiums. For vehicle owners in India, understanding these factors is key to making informed decisions.

Understanding Vehicle Insurance Basics in India

In India, understanding the basics of vehicle insurance is crucial for making informed decisions when purchasing a policy. Vehicle insurance is not just a legal requirement but also a financial safeguard against unforeseen events.

How Insurance Premiums Are Calculated

Insurance premiums in India are calculated based on several factors affecting SUV insurance premiums, including the vehicle’s make, model, age, and engine capacity. Insurers also consider the vehicle’s location, driver’s history, and other risk factors to determine the premium. For SUVs, the suv insurance costs can be higher due to their larger size and potentially higher repair costs.

Mandatory vs. Optional Coverage in the Indian Market

In India, vehicle insurance is categorized into mandatory and optional coverage. Mandatory coverage includes Third-Party Liability insurance, which is required by law. Optional coverage includes Comprehensive insurance, which covers damages to the insured vehicle. Understanding the difference between these options is essential for choosing the right insurance plan. Drivers should consider their vehicle’s value, driving habits, and financial situation when deciding on the level of coverage.

Are SUVs More Expensive to Insure?

In the Indian automotive insurance market, a key concern for car owners is understanding the differences in insurance premiums between SUVs and sedans. This concern is driven by various factors that influence the cost of insuring these vehicles.

Average Insurance Costs Comparison in India

When comparing the average insurance costs of SUVs and sedans in India, several factors come into play. SUVs generally have higher insurance premiums due to their larger size, higher repair costs, and increased risk of accidents. According to recent data, the average annual insurance premium for SUVs in India can range from ₹50,000 to ₹1,00,000, depending on the model and variant.

In contrast, sedans typically have lower insurance premiums, ranging from ₹30,000 to ₹70,000 per annum. This disparity is largely due to the lower repair and replacement costs associated with sedans, as well as their generally lower risk profile.

Statistical Data from Major Indian Insurers

Major Indian insurers have reported varying statistics on SUV and sedan insurance claims. For instance, a leading insurance provider in India observed that SUVs accounted for nearly 40% of all vehicle insurance claims in the past year, despite making up only about 25% of the total vehicles insured.

This data suggests that SUVs are not only more expensive to insure but also more likely to be involved in accidents or suffer significant damage. The statistical data from major Indian insurers underscores the importance of understanding the factors that drive SUV insurance rates and how they compare to those of sedans.

By examining the statistical data and average insurance costs, it becomes clear that SUVs are generally more expensive to insure than sedans in India. This is due to a combination of factors, including vehicle size, repair costs, and risk profiles.

Factors Affecting SUV Insurance Premiums

Understanding the factors that impact SUV insurance premiums is crucial for car owners. Insurance companies consider various elements when calculating premiums, and being aware of these can help SUV owners make informed decisions.

Vehicle Size, Weight, and Engine Capacity

The size, weight, and engine capacity of an SUV significantly influence its insurance premium. Generally, larger and heavier SUVs with more powerful engines are considered higher risk due to potential damage and repair costs. For instance, a study by a leading Indian insurer found that SUVs with engine capacities above 2000cc attract higher premiums due to increased power and potential for higher speeds.

Larger SUVs are often more expensive to insure because they can cause more damage in an accident. Insurers also consider the cost of repairs, which can be higher for larger vehicles with advanced features.

Safety Features and Their Impact on Premiums

Safety features play a crucial role in determining SUV insurance premiums. Vehicles equipped with advanced safety features such as airbags, anti-lock braking systems (ABS), and electronic stability control (ESC) are considered safer and may qualify for lower premiums. Insurers view these features as reducing the risk of accidents and injuries.

For example, an SUV with a 5-star safety rating and features like lane departure warning and blind-spot detection may be eligible for a discount on its insurance premium. Insurers like ICICI Lombard and New India Assurance offer such discounts, promoting safer vehicles.

Repair and Replacement Costs in India

The cost of repairing or replacing an SUV is a significant factor in determining its insurance premium. SUVs with expensive parts or those that are costly to repair will generally have higher premiums. The availability of spare parts and the labor costs in India also influence these costs.

In regions with higher labor costs, such as major cities, the cost of repairs can be significantly higher, impacting insurance premiums. Insurers consider these regional variations when calculating premiums for SUVs.

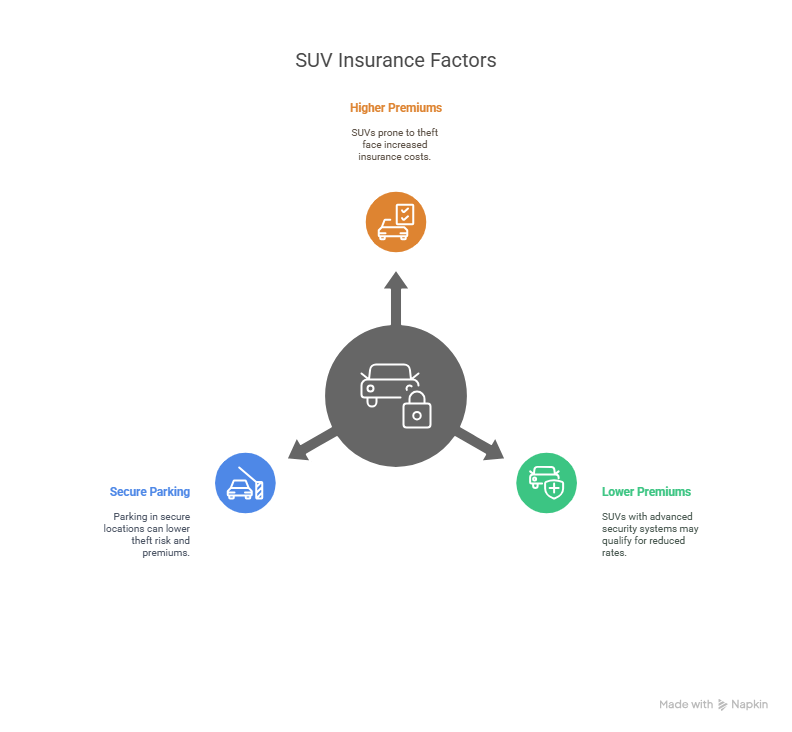

Theft Rates and Security Concerns

Theft rates and security concerns are other critical factors affecting SUV insurance premiums. SUVs that are more prone to theft or have higher theft rates in certain regions will attract higher premiums. Insurers assess the risk based on historical theft data and the effectiveness of the vehicle’s security features.

For instance, SUVs with advanced anti-theft systems and GPS tracking devices may be considered lower risk and eligible for lower premiums. Owners can also take additional measures such as parking in secure locations to reduce theft risk.

By understanding these factors, SUV owners in India can better navigate the insurance market and potentially reduce their insurance costs by making informed choices about their vehicle and insurance coverage.

Conclusion

In conclusion, the suv insurance cost analysis reveals that SUVs are generally more expensive to insure than sedans in India. This is due to various factors, including vehicle size, weight, engine capacity, safety features, repair, and replacement costs, as well as theft rates and security concerns.

As discussed, the average insurance costs for SUVs are higher compared to sedans, with major Indian insurers providing statistical data to support this claim. Understanding these factors can help you make informed decisions when purchasing vehicle insurance.

By considering these key findings, you can better navigate the Indian vehicle insurance market and choose the best insurance options for your needs. Whether you’re buying an SUV or a sedan, being aware of the factors that affect insurance premiums can help you save money and make a more informed decision.

Reference