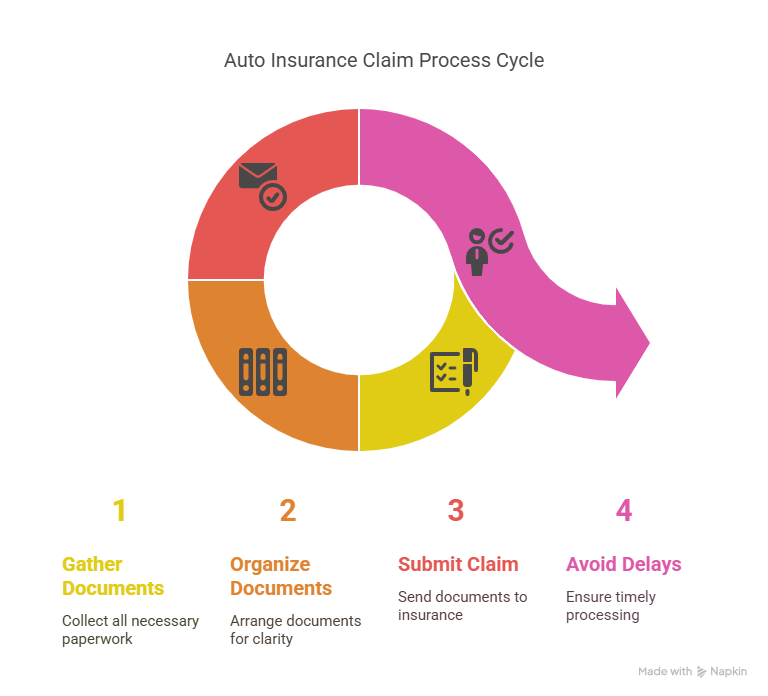

Being involved in a car accident can be a stressful experience, and navigating the insurance claims process can be overwhelming. Did you know that having the right documentation ready can significantly reduce the stress and ensure a smoother claims process?

After an accident, it’s crucial to gather all necessary information to file a claim efficiently. This includes having a comprehensive checklist of required documents and details. By understanding car insurance claim requirements, individuals can expedite their claim and get back on the road quickly.

Preparing an auto insurance claim checklist in advance can make a significant difference in the event of an accident. It ensures that all necessary steps are taken promptly, reducing the likelihood of delays or complications in the claims process.

What to Do Immediately After an Auto Accident

Knowing what to do immediately after an auto accident is crucial for a smooth step-by-step auto insurance claim process. The actions you take in the moments following a collision can significantly impact the outcome of your claim.

Safety First: Securing the Scene

Your safety is paramount. Move to a safe location if possible, and turn on hazard lights to alert other drivers. This helps prevent further incidents and ensures your safety.

Contacting the Police and Emergency Services

If the accident is severe or someone is injured, it’s essential to contact the police and emergency services. They will provide assistance and document the scene, which is vital for your claim.

Exchanging Information with Other Parties

Exchange contact and insurance information with the other parties involved. Be sure to get names, phone numbers, and policy details. This information is critical for filing your claim.

Documenting the Accident Scene

Take photos of the accident scene, including vehicle damage and any visible injuries. This visual evidence supports your claim and helps your insurance company understand what happened.

By following these steps, you can ensure that you’re well-prepared for the auto insurance claim process, making it easier to get back on the road.

Your Complete Auto Insurance Claim Checklist

Navigating the auto insurance claim process requires a comprehensive checklist to ensure all necessary documents are in order. This not only streamlines the process but also helps in avoiding potential pitfalls that could delay your claim.

Essential Personal and Policy Information

To start with, gather all essential personal and policy information. This foundational data is crucial for verifying your identity and policy details.

Policy Details and Coverage Information

Ensure you have your policy number, coverage limits, and deductibles readily available. This information is vital for determining the extent of your coverage.

Personal Contact Information

Having your up-to-date contact information, including phone numbers and email addresses, is essential for communication with your insurance provider.

Accident Details and Documentation

Documenting the accident is a critical step. Gather photos and videos of the scene, and if possible, obtain witness statements and their contact information.

Photos and Videos of the Scene

Capturing detailed images and videos of the accident scene can provide valuable evidence for your claim.

Witness Statements and Contact Information

Witness accounts can corroborate your version of events. Ensure you collect their statements and contact details.

Vehicle Damage Information

Assessing and documenting vehicle damage is another crucial aspect. Obtain repair estimates from reputable auto repair shops and keep records of your vehicle’s history and maintenance.

Repair Estimates

Get detailed repair estimates to support your claim. This helps in establishing the extent of the damage and the necessary repairs.

Vehicle History and Maintenance Records

Maintaining records of your vehicle’s history and regular maintenance can help in assessing its condition before the accident.

Medical Information (If Applicable)

If you’ve sustained injuries, it’s essential to document your medical reports and bills. Additionally, if your injuries have resulted in lost wages, gather documentation supporting your lost income.

Medical Reports and Bills

Keep detailed records of your medical treatment, including diagnosis, treatment plans, and medical expenses.

Lost Wages Documentation

If applicable, document any lost wages or income resulting from your injuries, as this can be part of your claim.

By following this comprehensive checklist, you’ll be well-prepared to file your auto insurance claim efficiently and effectively.

Finalizing Your Auto Insurance Claim

Being prepared with a comprehensive auto insurance claim checklist can significantly simplify the claims process. By understanding what to do immediately after an accident and gathering all necessary documentation, individuals can ensure a smoother experience.

A well-handled auto insurance claim investigation is crucial for a successful auto insurance claim settlement. With the right information, policyholders can navigate the insurance claim process with confidence, reducing the risk of delays or disputes.

By following the guidelines outlined in this article, individuals can ensure they are adequately prepared to file a claim, ultimately leading to a more efficient and effective auto insurance claim settlement.

FAQ

What is the first step in filing an auto insurance claim?

The first step is to ensure everyone’s safety, then contact the police and your insurance company to report the accident. Having your policy number and details of the accident ready will help streamline the process.

What information should I gather at the accident scene?

Gather photos or videos of the scene, witness statements, and contact information of other parties involved. This documentation will be crucial for your insurance claim.

How do I document vehicle damage for my insurance claim?

Take detailed photos or videos of the damage, and obtain repair estimates from reputable auto repair shops. Keeping records of your vehicle’s maintenance history can also be helpful.

What medical information do I need to provide for my auto insurance claim?

If you’ve been injured, you’ll need to provide medical reports, bills, and documentation of lost wages. This information will help support your claim for medical expenses and other related costs.

How long does the auto insurance claim process typically take?

The length of the claim process varies depending on the complexity of the case and the insurance company’s efficiency. Generally, it can take anywhere from a few days to several weeks or even months for the claim to be settled.

What happens during an auto insurance claim investigation?

The insurance company will review the documentation you’ve provided, interview witnesses, and may inspect the vehicle damage. They may also request additional information or clarification on certain aspects of your claim.

How can I ensure a successful auto insurance claim settlement?

To increase the chances of a successful settlement, ensure you have thorough documentation, including photos, witness statements, and medical records if applicable. Respond promptly to your insurance company’s requests, and consider consulting with a claims adjuster or attorney if you’re unsure about any part of the process.