Fleet owners in India understand the importance of keeping their business on the move. However, with numerous vehicles on the road, the risk of accidents, theft, or damage is ever-present.

Without adequate commercial auto insurance, a single unfortunate event can lead to significant financial losses. Choosing the right insurance plan can mitigate these risks, ensuring that your business continues to operate smoothly.

Having the best commercial vehicle insurance not only protects your assets but also enhances your business credibility. It’s a crucial step in safeguarding your fleet against unforeseen circumstances.

Understanding Commercial Vehicle Insurance for Fleet Management

As a fleet owner in India, understanding the nuances of commercial vehicle insurance can help you make informed decisions. Commercial vehicle insurance is designed to protect your business from financial losses due to accidents, theft, or damage to your vehicles.

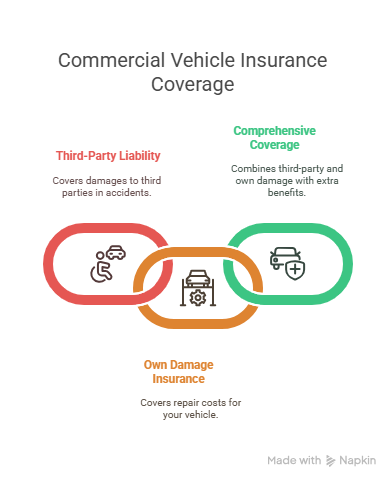

Types of Commercial Vehicle Coverage Available in India

India offers various types of commercial vehicle insurance coverage, including third-party liability, own damage, and comprehensive coverage. Top rated commercial vehicle coverage typically includes a combination of these to provide extensive protection.

- Third-party liability insurance covers damages to third parties involved in an accident.

- Own damage insurance covers repair costs for your vehicle in case of an accident or other damages.

- Comprehensive coverage combines third-party liability and own damage insurance, often with additional benefits.

Mandatory vs. Optional Coverage for Business Fleets

While third-party liability insurance is mandatory, other types of coverage are optional but highly recommended. Affordable business vehicle insurance plans often include a mix of mandatory and optional coverage to suit different business needs.

| Type of Coverage | Mandatory/Optional | Benefits |

|---|---|---|

| Third-party Liability | Mandatory | Covers damages to third parties |

| Own Damage | Optional | Covers repair costs for your vehicle |

| Comprehensive | Optional | Combines third-party and own damage coverage |

Factors Affecting Commercial Vehicle Insurance Premiums in India

Several factors influence cheapest commercial insurance premiums, including the type and age of your vehicles, driving history, and the level of coverage chosen. Understanding these factors can help you optimize your insurance costs.

Best Commercial Vehicle Insurance Providers in India

The Indian market offers several reliable fleet insurance providers that cater to the diverse needs of fleet owners. With numerous options available, it’s essential to evaluate the top commercial vehicle insurance providers to make an informed decision.

TATA AIG Commercial Vehicle Insurance

TATA AIG is a well-known insurance provider in India, offering comprehensive commercial vehicle insurance plans. Their policies are designed to provide extensive coverage for fleet owners.

Coverage Options and Benefits

- Third-party liability coverage

- Own damage coverage

- Coverage for driver and conductor

- Optional coverage for additional risks

Premium Rates and Discounts

TATA AIG offers competitive premium rates and discounts for fleet owners who insure multiple vehicles under a single policy. Discounts are also available for vehicles equipped with safety features.

HDFC ERGO Motor Fleet Insurance

HDFC ERGO is another prominent insurance provider in India, offering tailored motor fleet insurance solutions. Their policies are designed to meet the specific needs of fleet owners.

Coverage Options and Benefits

- Comprehensive coverage for vehicles

- Coverage for third-party liability

- Personal accident cover for drivers

- Optional coverage for additional risks

Premium Rates and Discounts

HDFC ERGO provides competitive premium rates and offers discounts for fleet owners with a good claims history. They also offer customized policies to suit specific business needs.

Bajaj Allianz Commercial Vehicle Insurance

Bajaj Allianz is a leading insurance provider in India, offering a range of commercial vehicle insurance plans. Their policies are designed to provide comprehensive coverage for fleet owners.

Coverage Options and Benefits

- Third-party liability coverage

- Own damage coverage

- Coverage for driver and conductor

- Optional coverage for additional risks

Premium Rates and Discounts

Bajaj Allianz offers competitive premium rates and discounts for fleet owners who insure a large number of vehicles. They also provide discounts for vehicles with advanced safety features.

ICICI Lombard Commercial Vehicle Insurance

ICICI Lombard is a reputable insurance provider in India, offering comprehensive commercial vehicle insurance plans. Their policies are designed to provide extensive coverage for fleet owners.

Coverage Options and Benefits

- Comprehensive coverage for vehicles

- Coverage for third-party liability

- Personal accident cover for drivers

- Optional coverage for additional risks

Premium Rates and Discounts

ICICI Lombard provides competitive premium rates and offers discounts for fleet owners with a good claims history. They also offer customized policies to suit specific business needs.

New India Assurance Commercial Vehicle Policy

New India Assurance is a well-established insurance provider in India, offering comprehensive commercial vehicle insurance plans. Their policies are designed to provide extensive coverage for fleet owners.

Coverage Options and Benefits

- Third-party liability coverage

- Own damage coverage

- Coverage for driver and conductor

- Optional coverage for additional risks

Premium Rates and Discounts

New India Assurance offers competitive premium rates and discounts for fleet owners who insure multiple vehicles under a single policy. Discounts are also available for vehicles equipped with safety features.

Conclusion: Choosing the Right Commercial Vehicle Insurance for Your Fleet

Selecting the right commercial vehicle insurance is crucial for fleet owners in India. With various business auto policy options available, it’s essential to consider your specific needs and choose a policy that offers the best coverage and value.

Fleet owners can benefit from specialized commercial vehicle coverage that caters to their unique requirements. By understanding the types of commercial vehicle coverage available and the factors affecting insurance premiums, fleet owners can make informed decisions.

Leading insurance providers such as TATA AIG, HDFC ERGO, Bajaj Allianz, ICICI Lombard, and New India Assurance offer a range of commercial vehicle insurance plans. By comparing these plans and considering factors such as coverage, premiums, and customer service, fleet owners can choose the best insurance policy for their business.

Ultimately, the right commercial vehicle insurance can help protect your business from financial losses and ensure compliance with regulatory requirements. By choosing a policy that meets your needs, you can drive your business forward with confidence.

Reference

https://www.youtube.com/user/PolicyBazaar