Did you know that nearly 20% of drivers in India are driving without valid car insurance, often due to unawareness of the renewal process or the consequences of letting their policy lapse?

Letting your insurance policy expire can lead to severe penalties, including hefty fines and even license suspension. In India, driving without insurance can result in a fine of up to ₹2,000 and/or imprisonment for up to 3 months.

Renewing your insurance on time is crucial to avoid these consequences. Understanding the consequences of not renewing car insurance and knowing how to renew your policy efficiently can save you from legal troubles and financial losses.

Understanding Car Insurance Expired Fine in India

Understanding the legal implications of expired car insurance is crucial for every vehicle owner in India. Car insurance is not just a legal requirement but also a financial safety net in case of accidents or damages.

Legal Requirements for Car Insurance in India

In India, having car insurance is mandatory as per the Motor Vehicles Act, 1988. Every vehicle owner must have at least a third-party liability insurance cover. This insurance type covers damages to other people or their property in case of an accident. Driving without valid car insurance can lead to penalties and fines.

Penalties and Fines Under the Motor Vehicles Act

The Motor Vehicles Act, 1988, outlines specific penalties for driving without valid car insurance. If caught, you can be fined ₹2,000 for the first offense, and for subsequent offenses, the fine can go up to ₹4,000. Additionally, your driver’s license can be suspended or canceled. The severity of the penalty may vary based on the discretion of the authorities.

Traffic Tickets and Court Proceedings

If you’re driving with expired car insurance and are stopped by traffic police, you can expect to receive a traffic ticket. This ticket will require you to appear in court, where the fine and penalty will be determined based on the circumstances. It’s advisable to renew your car insurance on time to avoid such legal hassles and financial penalties.

Consequences of Letting Your Car Insurance Lapse

When you let your car insurance expire, you’re not just risking a fine; you’re exposing yourself to a multitude of financial and legal issues. The lapse in your car insurance coverage can lead to several adverse consequences that affect your financial stability and driving privileges.

Financial Risks in Case of Accidents

If you’re involved in an accident without valid car insurance, you could be held personally liable for damages or injuries. This could lead to significant financial strain, potentially impacting your savings and assets. For instance, if you’re at fault in an accident, you might have to cover:

| Expense Type | Potential Cost |

|---|---|

| Vehicle Repairs | Up to ₹5 lakhs or more |

| Medical Expenses | Up to ₹10 lakhs or more per person |

| Legal Fees | ₹1 lakh to ₹5 lakhs |

Loss of No-Claim Bonus Benefits

Allowing your car insurance to lapse means you might lose the No-Claim Bonus (NCB) you’ve accumulated. NCB is a discount on your premium for each claim-free year. Losing this bonus can increase your premium when you reinstate your policy. For example, an NCB of 20% can save you a significant amount on your annual premium.

Higher Premium Rates After Policy Reinstatement

Reinstating a lapsed car insurance policy can be more expensive than maintaining continuous coverage. Insurers may view a lapse as a higher risk, leading to higher premium rates. Additionally, you might be required to pay a late fee or penalty for the expired period.

To avoid these consequences, it’s crucial to renew your car insurance on time and maintain continuous coverage. This not only protects you financially but also ensures you comply with legal requirements.

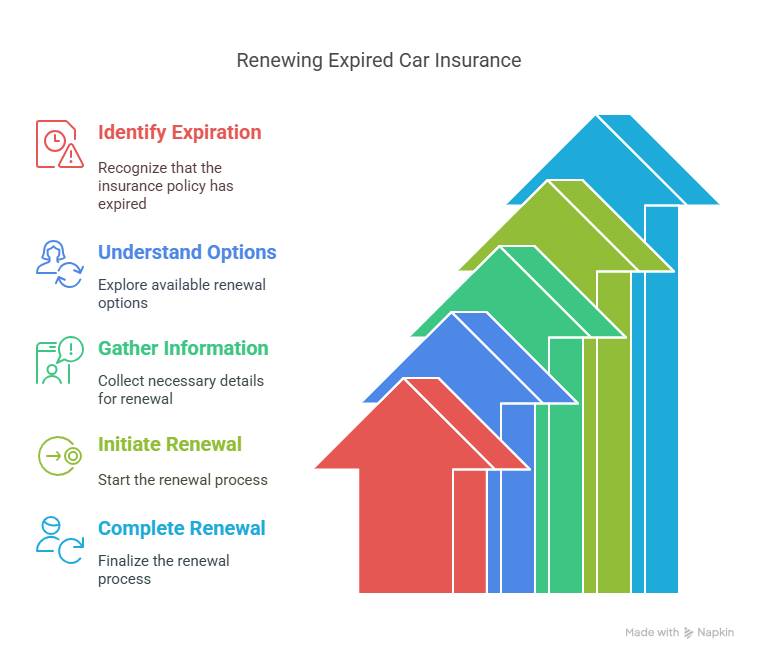

How to Renew Your Expired Car Insurance

If your car insurance has lapsed, knowing the steps to reinstate it is crucial for avoiding legal and financial complications. Renewing your car insurance after expiration is a process that requires attention to detail and an understanding of the options available to you.

Grace Period Options from Indian Insurers

Many Indian insurers offer a grace period for renewing expired car insurance policies. This grace period can vary between insurers, so it’s essential to check with your provider to understand their specific policies and avoid any potential penalties.

Online Renewal Process and Documentation

Renewing your car insurance online is convenient and time-efficient. You’ll need to provide your policy number, vehicle details, and other relevant information. Ensure you have all necessary documents ready, including your previous policy documents and any additional required information.

The documentation required for renewing an expired car insurance policy typically includes proof of identity, vehicle registration, and previous insurance documents. Some insurers may request additional information, so it’s a good idea to check with your insurer beforehand.

Vehicle Inspection Requirements After Expiration

After a policy has expired, some insurers may require a vehicle inspection before renewing the policy. This is to assess the vehicle’s condition and ensure it meets the insurer’s requirements. The inspection process can vary, so it’s best to inquire about the specifics with your insurance provider.

Tips to Avoid Future Policy Lapses

To avoid the hassle of renewing an expired policy, consider setting reminders for your policy renewal date. Some insurers also offer auto-renewal services that can simplify the process and ensure your policy remains active without interruption.

Conclusion

Letting your car insurance expire can lead to significant financial risks and legal penalties in India. Understanding the implications of a car insurance expired fine and knowing how to renew your policy after expiration are crucial steps in maintaining valid car insurance.

If your car insurance has lapsed, renewing car insurance after expiration is a straightforward process, especially when done within the grace period offered by many Indian insurers. Ensuring timely renewal avoids fines, penalties, and potential legal issues under the Motor Vehicles Act.

By being proactive and aware of the renewal process, you can avoid the financial risks associated with accidents and the loss of no-claim bonus benefits. Stay informed, and take the necessary steps to keep your car insurance active, safeguarding your financial security on the road.

FAQ

What is the fine for driving with expired car insurance?

The fine for driving with expired car insurance can vary, but in India, it can range from ₹2,000 to ₹4,000 under the Motor Vehicles Act, depending on the state and the discretion of the traffic authorities.

What happens if I don’t renew my car insurance on time?

If you don’t renew your car insurance on time, you may face penalties, fines, and even have to pay higher premium rates when you reinstate your policy. Additionally, you’ll be exposed to financial risks in case of an accident.

Can I renew my car insurance after it has expired?

Yes, you can renew your car insurance after it has expired. Many Indian insurers offer a grace period, allowing you to renew your policy without a significant gap in coverage. However, it’s essential to check with your insurer for their specific policies and procedures.

Will I lose my No-Claim Bonus if my car insurance lapses?

Yes, if your car insurance lapses, you may lose your No-Claim Bonus benefits. The No-Claim Bonus is a discount on your premium for not making any claims during the policy period. To maintain this benefit, it’s crucial to keep your insurance policy active without any gaps.

How can I avoid future policy lapses?

To avoid future policy lapses, you can set reminders for your policy renewal date, opt for auto-renewal services if offered by your insurer, and ensure you have sufficient funds to pay your premium on time.

Are there any additional fees for reinstating an expired car insurance policy?

Yes, reinstating an expired car insurance policy may involve additional fees, such as late fees or higher premium rates. The exact charges depend on the insurer’s policies and the duration of the lapse.

Can I get a traffic ticket for driving with expired insurance?

Yes, driving with expired insurance can result in a traffic ticket. If you’re caught driving without valid insurance, you may be fined and potentially face court proceedings.

What are the consequences of an auto insurance lapse?

An auto insurance lapse can lead to financial risks in case of accidents, loss of No-Claim Bonus benefits, and higher premium rates when you reinstate your policy. It can also result in fines and penalties if you’re caught driving without valid insurance.

How do I renew my car insurance online?

To renew your car insurance online, visit your insurer’s website, log in to your account, and follow the renewal process. You’ll need to provide necessary documentation, such as your vehicle’s registration and previous policy details, and pay the premium online.

Is a vehicle inspection required after car insurance expiration?

In some cases, a vehicle inspection may be required after car insurance expiration, especially if the lapse has been significant. Check with your insurer to determine if an inspection is necessary for your vehicle.

Reference

https://www.youtube.com/@FinologyLegal