Buying or selling a vehicle can be a complex process, and understanding the intricacies of auto insurance transfer is crucial. In India, when a vehicle changes hands, the insurance policy doesn’t automatically transfer to the new owner. This raises important questions about the costs involved in transferring the policy.

For both buyers and sellers, being aware of transferring auto insurance prices can help avoid unexpected expenses. It’s essential to consider these costs to ensure a smooth transaction. As we delve into this guide, we’ll explore the key aspects to consider during the insurance transfer process, making it easier for you to navigate this often-overlooked aspect of vehicle ownership transfer.

Understanding Car Insurance Transfer in India

Car insurance transfer is a mandatory process in India, and understanding its intricacies can save buyers and sellers from potential legal issues. When a vehicle is sold, the insurance policy does not automatically transfer to the new owner. Instead, the buyer must initiate the transfer process to ensure continuous coverage.

Legal Requirements for Insurance Transfer

The Motor Vehicles Act of 1988 mandates that car insurance be transferred when ownership changes. The buyer must notify the insurance provider within 14 days of purchasing the vehicle, involving a car insurance policy transfer fee.

Timeframe for Transferring Car Insurance

The insurance transfer process typically takes a few days to a couple of weeks, depending on the insurer’s efficiency and the completeness of the documentation. Understanding the car insurance transfer fees and charges involved can help manage expectations.

Consequences of Not Transferring Insurance

Failure to transfer insurance can result in legal penalties and financial losses in case of an accident. Here’s a summary:

| Consequence | Description |

|---|---|

| Legal Penalties | Fines and legal action for non-compliance |

| Financial Losses | Out-of-pocket expenses for damages or liabilities |

Car Insurance Transfer Charges Explained

In India, switching car insurance or transferring it to a new owner involves certain fees that are critical to know. Understanding these charges is essential for both buyers and sellers to navigate the process smoothly.

Standard Transfer Fees in India

Insurance companies in India charge standard transfer fees for car insurance policies. These fees can vary between providers, so it’s essential to check with your insurer. The transfer fee is typically a fixed amount, and it’s usually a one-time payment.

No Claim Bonus Considerations

The No Claim Bonus (NCB) is a significant factor in car insurance transfers. When transferring insurance, the NCB is also transferred to the new owner, provided the policy is transferred within the stipulated timeframe. This can significantly impact the premium for the new owner.

Additional Charges to Be Aware Of

Besides the standard transfer fees, there are other charges to consider. These include administrative fees and pro-rata premium adjustments.

Administrative Fees

Administrative fees are charged by insurance companies for handling the transfer process. These fees can vary and are usually nominal.

Pro-rata Premium Adjustments

Pro-rata premium adjustments occur when the insurance premium is adjusted according to the remaining policy period. This ensures that the buyer or seller is not overcharged.

Understanding these charges can help both parties plan their finances better and avoid any last-minute surprises during the car insurance transfer process.

Buyer vs Seller: Insurance Transfer Process

When buying or selling a vehicle, understanding the insurance transfer process is crucial for both parties. This process involves several key steps and responsibilities that must be undertaken to ensure a smooth transfer of car insurance.

Seller’s Responsibilities and Costs

The seller’s primary responsibility is to notify the insurance company about the change of ownership. This typically involves submitting a written request along with the required documents. Sellers may incur costs associated with the transfer, including any applicable transfer fees.

- Notify the insurance company about the change of ownership

- Submit required documents for the transfer

- Pay any applicable transfer fees

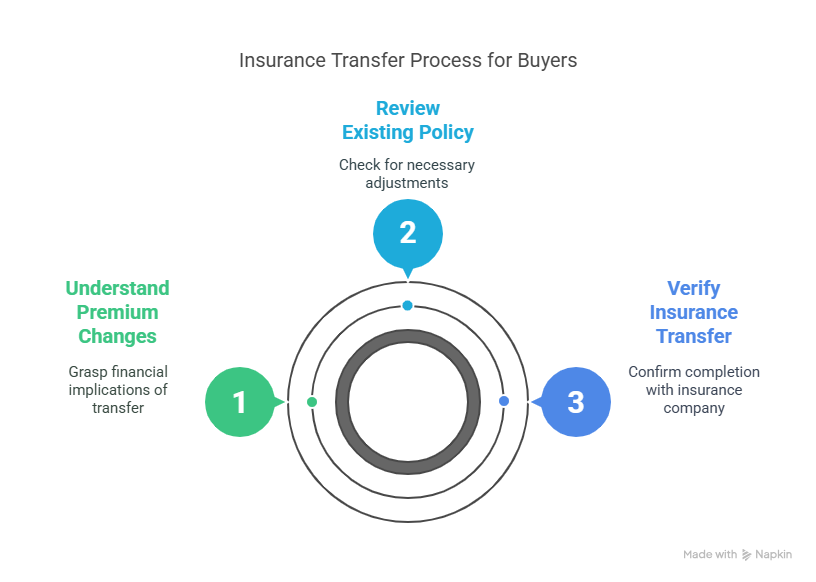

Buyer’s Steps and Financial Implications

Buyers must verify that the insurance transfer has been completed and understand any financial implications, such as changes in car insurance premium transfer charges. They should also review the existing policy to determine if any adjustments are needed.

- Verify the insurance transfer with the insurance company

- Review the existing policy for any necessary adjustments

- Understand any changes in premium costs

Documentation Required for Both Parties

Both buyers and sellers need to be aware of the necessary documentation for the insurance transfer. This includes essential forms and certificates, which can be submitted digitally or physically.

Essential Forms and Certificates

The required documents typically include the insurance policy documents, vehicle registration proof, and identification proof. It’s essential to ensure all documents are accurate and up-to-date.

Digital vs Physical Documentation

While digital documentation offers convenience and speed, physical documentation may still be required in some cases. Buyers and sellers should be prepared to provide documentation in the required format.

Transferring Car Insurance: A Crucial Step

Understanding the costs associated with transferring car insurance is vital for both buyers and sellers in India. The process involves various charges, including transfer fees and potential impacts on no-claim bonuses.

Being aware of these costs and the steps involved in transferring car insurance can help individuals navigate the process smoothly, avoiding unnecessary expenses and ensuring compliance with legal requirements.

By considering the transferring car insurance costs and following the necessary procedures, buyers and sellers can facilitate a hassle-free transfer, securing their financial interests and maintaining continuous insurance coverage.

FAQ

What are the car insurance transfer charges in India?

The car insurance transfer charges in India vary among insurance providers, but typically include a transfer fee ranging from ₹500 to ₹2,000, depending on the insurer and the type of vehicle.

Are there any additional costs associated with transferring car insurance?

Yes, apart from the standard transfer fee, additional costs may include administrative fees, pro-rata premium adjustments, and other charges, which can vary depending on the insurance company and the specifics of the transfer.

How does the No Claim Bonus (NCB) affect car insurance transfer charges?

The NCB can significantly impact the transfer charges, as it is typically transferred along with the insurance policy. The new owner can benefit from the NCB, but if the NCB is not transferred correctly, it may result in additional premium costs.

What are the consequences of not transferring car insurance to the new owner?

Failing to transfer car insurance can lead to legal and financial repercussions, including penalties and fines. The new owner may not be covered in case of an accident or damage, and the seller may still be liable for any claims made.

What documentation is required for transferring car insurance?

The required documentation typically includes the insurance policy documents, vehicle registration certificate, and identification proof of the new owner. Some insurers may also require additional forms or certificates, such as a transfer request form.

Can I transfer my car insurance online?

Yes, many insurance providers in India offer online facilities for transferring car insurance, making it a convenient and time-saving process. However, some insurers may still require physical documentation or verification.

How long does it take to transfer car insurance in India?

The timeframe for transferring car insurance can vary depending on the insurer and the complexity of the transfer. Typically, it can take anywhere from a few days to a couple of weeks to complete the transfer process.

Are there any fees associated with switching car insurance providers during a transfer?

Yes, switching car insurance providers during a transfer may involve fees, including transfer charges and potentially some administrative costs, depending on the new insurer’s policies.

Can the new owner negotiate the car insurance transfer charges?

In some cases, the new owner may be able to negotiate the transfer charges or other costs associated with the transfer, but this largely depends on the insurance provider’s policies and the terms of the transfer.

What is the impact of car insurance transfer on the premium costs?

The impact of car insurance transfer on premium costs can vary, as it depends on several factors, including the new owner’s profile, the vehicle’s condition, and the insurer’s pricing policies. The transfer may result in changes to the premium costs, either increasing or decreasing it.

Reference