Imagine driving your new car off the dealership lot, feeling the thrill of the open road, only to be hit with the unexpected expense of car insurance. For many, credit cards offering insurance perks can be a game-changer, providing a layer of financial protection against unforeseen events.

Using a credit card with insurance can simplify your financial management by consolidating expenses and potentially reducing the need for separate insurance policies. However, it’s crucial to understand the benefits and risks associated with such cards to make an informed decision.

The benefits of using credit cards with insurance include financial protection and convenience. Yet, there are also potential downsides to consider. This article will explore both aspects, helping you navigate the complexities and choose the right credit card for your needs.

Understanding Credit Card with Insurance Benefits for Vehicles

When it comes to vehicle insurance, many are unaware that certain credit cards offer built-in car insurance benefits. These benefits can provide significant financial protection against accidents or damages.

Credit cards with insurance benefits can be a valuable addition to one’s financial toolkit, especially for frequent travelers or daily commuters.

Types of Car Insurance Coverage Offered

Credit cards may offer various types of car insurance coverage, including collision damage waiver and personal accident insurance. Understanding these coverage types is crucial for maximizing the benefits.

| Coverage Type | Description | Benefit |

|---|---|---|

| Collision Damage Waiver | Covers damages to rental cars in case of an accident | Reduces financial liability |

| Personal Accident Insurance | Provides financial protection in case of injury or death | Offers peace of mind |

How Credit Card Car Insurance Works in India

In India, credit card car insurance typically works as a complimentary benefit when you use your credit card to pay for rental cars or fuel. The insurance coverage is usually secondary, meaning it kicks in after your primary insurance coverage is exhausted.

To avail of this benefit, cardholders often need to meet specific conditions, such as activating the insurance benefit or fulfilling certain spending requirements.

Top Credit Cards with Car Insurance Benefits in India

In India, several credit cards offer car insurance benefits, catering to diverse needs and preferences. These credit cards can be categorized based on their usage and benefits, providing cardholders with a range of options to choose from.

Premium Travel Credit Cards

Premium travel credit cards often come with comprehensive car insurance benefits, especially when used for booking rental cars or travel-related expenses. Cards like the American Express Platinum Travel Credit Card offer robust insurance coverage, including car rental insurance, making them ideal for frequent travelers.

Everyday Use Credit Cards with Insurance

Some everyday use credit cards also offer car insurance benefits, providing cardholders with added protection. For instance, the ICICI Bank Amazon Pay Credit Card offers insurance coverage on car rentals, making it a practical choice for daily expenses.

Co-Branded Auto Credit Cards

Co-branded auto credit cards, such as those partnered with automobile manufacturers, often include car insurance benefits. The Maruti Suzuki Co-Branded Credit Card is an example, offering insurance coverage and other benefits tailored to car owners.

By understanding the different types of credit cards that offer car insurance benefits, cardholders can make informed decisions and choose the best card for their needs.

Key Benefits of Using Credit Card with Insurance for Your Vehicle

Using a credit card with insurance benefits for your vehicle can be a game-changer in terms of financial security and travel convenience. These cards offer a range of benefits that can enhance your overall travel and ownership experience.

The advantages of using such credit cards are multifaceted. Some of the key benefits include:

- Cost savings on rental cars

- Emergency roadside assistance services

- Additional protection beyond standard insurance

Cost Savings on Rental Cars

One of the significant benefits of using credit cards with insurance is the cost savings on rental cars. Many premium credit cards offer insurance coverage for rental vehicles, reducing the need for additional insurance from the rental company.

Emergency Roadside Assistance Services

Insurance benefits credit cards often come with emergency roadside assistance services, providing help in case of a breakdown or accident. This service can be a lifesaver, especially during long trips.

Additional Protection Beyond Standard Insurance

Using a credit card with insurance can provide additional protection beyond standard insurance. This can include coverage for damages or losses not covered by your primary insurance policy, enhancing your overall financial security.

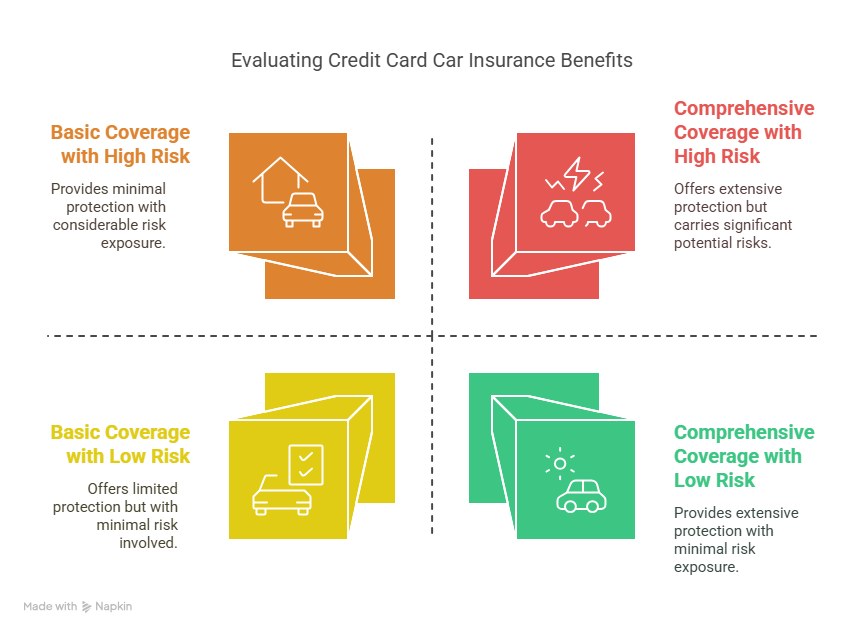

Potential Risks and Limitations to Consider

Before opting for a credit card with car insurance benefits, it’s essential to understand the potential risks and limitations. While these credit cards offer numerous advantages, there are also potential drawbacks to be aware of.

Understanding the risks involved is crucial to making an informed decision. Credit cards with insurance benefits can be beneficial, but they may not provide comprehensive coverage in all situations.

Coverage Gaps and Exclusions

One of the primary concerns is the potential for coverage gaps and exclusions. Certain credit card insurance policies may not cover specific types of vehicles, drivers, or situations, leaving you vulnerable to financial losses.

For instance, some credit cards may not provide coverage for rental cars in certain countries or for drivers under a specific age. It’s essential to carefully review the policy terms to understand what’s included and what’s excluded.

Activation Requirements and Documentation

Another important consideration is the activation requirements and documentation needed to avail of the insurance benefits. Some credit cards may require you to activate the insurance coverage by performing specific actions, such as paying for the rental car using the credit card or registering for the insurance benefit.

Additionally, you may need to provide documentation, such as proof of rental or driving records, to file a claim. Understanding these requirements can help you avoid any potential issues or delays in the claims process.

Conclusion: Making the Right Choice for Your Needs

When selecting a credit card, it’s essential to consider the insurance benefits that come with it, particularly for vehicles. The best credit cards with insurance coverage offer a range of protection plans, including credit card protection plans and credit card travel insurance options.

By understanding the types of car insurance coverage offered and how they work, you can make an informed decision that suits your specific needs. Whether you’re looking for cost savings on rental cars or emergency roadside assistance services, choosing the right credit card can provide you with additional protection beyond standard insurance.

As you’ve seen, top credit cards in India offer various insurance benefits. Be sure to review the coverage gaps, exclusions, and activation requirements to ensure you’re getting the most out of your credit card’s insurance benefits.

Reference