Navigating the car insurance claim process can be daunting, but understanding how it works is crucial for financial protection.

In India, having a valid car insurance policy is not just a legal requirement, but also a safeguard against unforeseen circumstances on the road.

This guide will walk you through the step-by-step process of filing a claim, ensuring you’re well-prepared to handle the unexpected.

Understanding Car Insurance Claims in India

Navigating the world of car insurance claims in India can be complex, but understanding the process is crucial for a smooth experience. Car insurance claims are a critical aspect of vehicle ownership, providing financial protection against unforeseen events.

Types of Car Insurance Claims in India

There are primarily two types of car insurance claims in India: Own Damage Claims and Third-Party Claims. Own Damage Claims are filed when your vehicle is damaged, stolen, or vandalized. Third-Party Claims are filed when your vehicle is involved in an accident causing damage to another person’s property or injury to someone.

Important Policy Terms That Affect Your Claim

Understanding your car insurance policy terms is vital for a successful claim. Key terms include Deductible, Depreciation, and No Claim Bonus. A deductible is the amount you must pay out of pocket before your insurance kicks in. Depreciation refers to the decrease in your vehicle’s value over time, affecting the claim amount. No Claim Bonus is a discount on your premium for not making a claim in the previous year.

How Car Insurance Claim Works: Complete Process

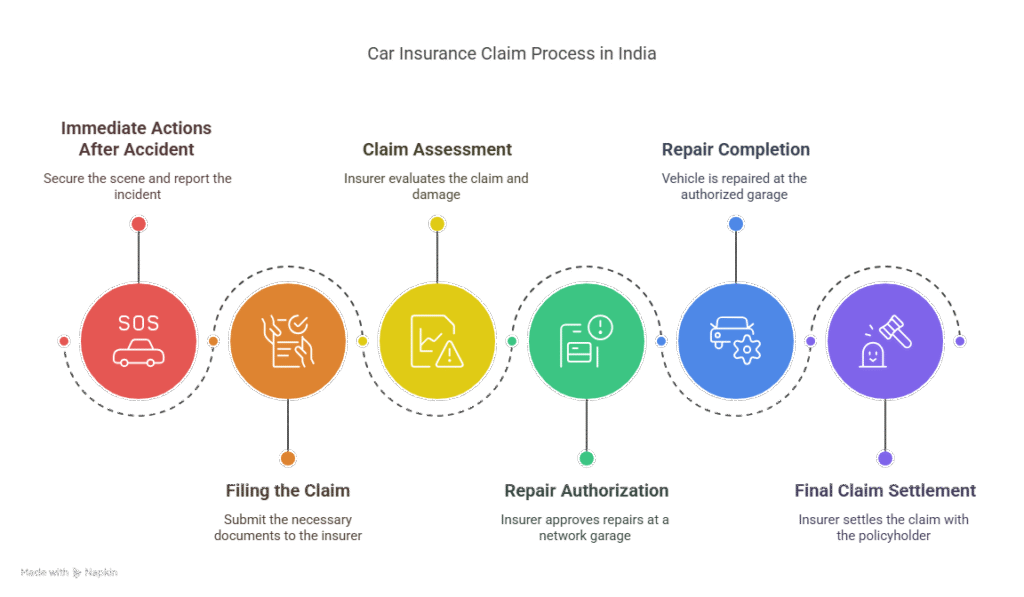

Navigating the car insurance claim process in India can be complex, but understanding the steps involved can make it more manageable. The process involves several key stages, from immediate actions after an accident to the final claim settlement.

Immediate Steps After an Accident

After an accident, it’s crucial to take the right steps to ensure a smooth claim process. This includes documenting the scene and, if necessary, filing an FIR.

Documenting the Accident Scene

Documenting the accident scene is vital. Take photos of the damage and note the location, time, and parties involved. This documentation will be essential for your claim.

Filing an FIR When Necessary

If the accident involves significant damage or injury, filing an FIR is necessary. This official record will be required for your insurance claim.

Notifying Your Insurance Provider

Notify your insurance provider as soon as possible after the accident. They will guide you through the next steps and provide the necessary claim forms.

Submitting Your Claim Application

Submitting your claim application involves gathering all required documents and filling out the claim form accurately.

Essential Documents for Claim Processing

Essential documents include your insurance policy details, FIR copy (if applicable), and proof of ownership. Ensure you have all necessary car insurance claim documentation.

Digital vs. Physical Submission Methods

Most insurance companies now offer digital submission methods, making it easier to submit your claim. However, some may still require physical submission, so it’s essential to check with your provider.

Vehicle Inspection and Damage Assessment

After submitting your claim, the insurance company will arrange for a vehicle inspection to assess the damage. This step is crucial for determining the validity of your claim and the extent of the damage.

Claim Approval and Settlement Process

Once the damage assessment is complete, the insurance company will process your claim. If approved, they will offer a settlement based on your policy terms. Understanding your policy’s car insurance claim compensation terms is vital.

Common Reasons for Claim Rejection in India

Claims can be rejected due to various reasons, including incomplete documentation, policy lapses, or discrepancies in the claim application. Being aware of these potential pitfalls can help you avoid them.

Conclusion: Ensuring a Smooth Car Insurance Claim Experience

Understanding the car insurance claim process in India is crucial for a hassle-free experience. By knowing the steps involved in the car insurance claim settlement, you can navigate the process with ease. From notifying your insurance provider to submitting the claim application and undergoing vehicle inspection, each step plays a vital role in ensuring a smooth claim experience.

Being aware of the common reasons for claim rejection can also help you avoid potential pitfalls. By following the guidelines outlined in this article, you can ensure that your car insurance claim is processed efficiently, resulting in a timely claim settlement.

A smooth car insurance claim experience not only reduces stress but also helps you get back on the road quickly. Stay informed, be prepared, and make the most of your car insurance policy.

FAQ

What is the first step in filing a car insurance claim in India?

The first step is to notify your insurance provider about the accident or damage to your vehicle, providing them with the necessary details and documentation.

What documents are required for car insurance claim processing?

Essential documents include the insurance policy, driving license, vehicle registration certificate, FIR copy (if applicable), and any other relevant documents specified by the insurance provider.

How long does it take to settle a car insurance claim in India?

The time taken to settle a car insurance claim can vary depending on the complexity of the claim, the insurance provider, and the documentation submitted. Typically, it can range from a few days to several weeks.

What are the common reasons for car insurance claim rejection in India?

Common reasons for claim rejection include non-disclosure of information, policy lapses, lack of necessary documentation, and claims falling under policy exclusions.

Can I file a car insurance claim online?

Yes, many insurance providers in India offer online claim submission through their websites or mobile apps, making the process more convenient and efficient.

How can I ensure a smooth car insurance claim experience?

To ensure a smooth claim experience, it’s essential to understand your policy terms, document the accident scene thoroughly, notify your insurance provider promptly, and submit all required documents accurately and on time.

What is the role of surveyors in the car insurance claim process?

Surveyors assess the damage to your vehicle, verify the claim details, and provide a report to the insurance provider, which helps in determining the claim settlement amount.

Can I appeal a rejected car insurance claim?

Yes, if your claim is rejected, you can appeal the decision by providing additional information or clarifying any discrepancies, and the insurance provider will re-evaluate your claim.

Reference

https://www.youtube.com/@MyInsuranceClub