Did you know that opting for a higher deductible can significantly lower your insurance costs? In the United States, many individuals overlook the potential insurance cost reduction that comes with choosing a higher deductible plan.

By understanding how deductibles impact insurance premiums, you can make informed decisions about your insurance coverage. Essentially, a deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles often result in lower premiums, as you’re taking on more of the financial risk.

This doesn’t mean everyone should rush to higher deductible plans. It’s crucial to weigh the potential premium savings against the increased financial risk. By doing so, you can find a balance that works for your financial situation.

Understanding Insurance Deductibles and Premiums

To make informed decisions about your insurance, it’s crucial to understand how deductibles and premiums work together. This understanding can help you optimize your insurance costs and choose a plan that best suits your financial situation.

What Is a Deductible?

A deductible is the amount you pay out of pocket for expenses related to a claim before your insurance coverage kicks in. For instance, if you have a $1,000 deductible and you incur $5,000 in medical expenses due to an accident, you’ll need to pay the first $1,000, and your insurance will cover the remaining $4,000. Choosing a higher deductible can lead to lower premiums, as it indicates to the insurer that you’re taking on more of the financial risk.

The Relationship Between Deductibles and Premiums

The deductible and premium have an inverse relationship: higher deductibles typically result in lower premiums, while lower deductibles lead to higher premiums. This is because when you opt for a higher deductible, you’re essentially taking on more financial responsibility in the event of a claim, which reduces the insurer’s risk and, consequently, your premium. For example, increasing your deductible from $500 to $1,000 could reduce your annual premium by 10% to 20%, depending on the insurance provider and policy. It’s essential to strike a balance between deductible and premium to achieve optimal deductible savings strategies and effective premium cost analysis.

The High Deductible Premium Savings Impact

The decision to choose a high deductible plan hinges on understanding its impact on premium savings. By opting for a higher deductible, individuals can significantly lower their insurance premiums, but it’s crucial to weigh this against the potential out-of-pocket expenses.

How Much Can You Actually Save?

Choosing a high deductible plan can lead to substantial savings on premiums. For instance, increasing your deductible from $500 to $1,000 can reduce your annual premium by up to 30%. Here are some potential savings examples:

- Reducing premiums by $200-$500 annually by increasing the deductible.

- Saving up to 40% on premiums for healthy individuals who rarely file claims.

When High Deductibles May Not Be Cost-Effective

While high deductible plans offer premium savings, they may not be suitable for everyone. If you frequently require medical services or have ongoing health issues, a lower deductible plan might be more cost-effective despite higher premiums.

Real-World Savings Examples

Consider the case of a healthy individual who opted for a high deductible plan and saved $350 annually on premiums. In contrast, a family with multiple medical needs might find a lower deductible plan more economical, despite higher premiums.

Strategies to Maximize Savings with High Deductible Plans

Adopting a high deductible plan can lead to significant savings, provided you manage it wisely. To make the most of such plans, it’s essential to have a comprehensive strategy in place.

Building an Emergency Fund

One crucial strategy is building an emergency fund to cover the deductible when needed. This fund acts as a financial cushion, ensuring you’re not caught off guard by medical expenses. Aim to save at least three to six months’ worth of expenses.

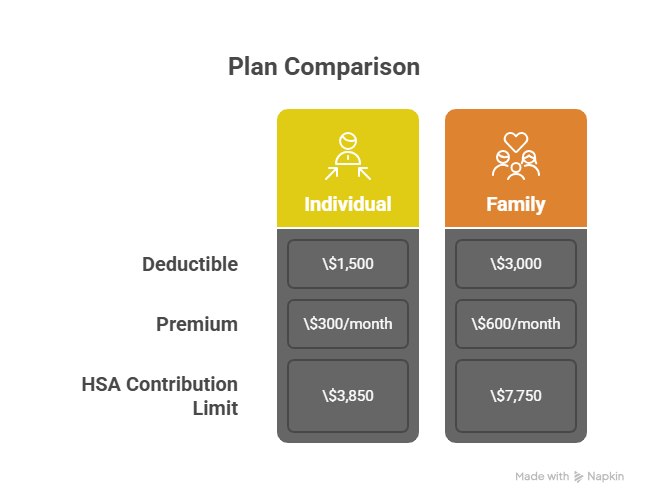

Health Savings Accounts (HSAs) and Tax Benefits

Utilizing a Health Savings Account (HSA) can provide additional savings. HSAs offer tax benefits, as contributions are tax-deductible, and the funds grow tax-free. For example, in 2023, individuals can contribute up to $3,850 to an HSA, and families can contribute up to $7,750.

| Plan Type | Deductible | Premium | HSA Contribution Limit |

|---|---|---|---|

| Individual | $1,500 | $300/month | $3,850 |

| Family | $3,000 | $600/month | $7,750 |

Comparing Plans: Finding Your Optimal Deductible Level

Comparing different insurance plans is vital to finding the most cost-effective option. Consider factors like deductible levels, premiums, and out-of-pocket maximums. For instance, a plan with a higher deductible might offer lower premiums but could result in higher out-of-pocket costs if you need medical care.

Conclusion: Balancing Deductibles and Financial Security

Choosing the right insurance deductible is crucial for achieving insurance cost reduction. By understanding the relationship between deductibles and premiums, individuals can make informed decisions that lead to significant savings. High deductible plans, in particular, offer a substantial high deductible premium savings impact, making them an attractive option for those who want to lower their insurance costs.

To maximize the benefits of high deductible plans, it’s essential to strike a balance between deductible levels and financial security. Building an emergency fund and utilizing Health Savings Accounts (HSAs) can help individuals prepare for potential out-of-pocket expenses. By doing so, they can enjoy the savings offered by high deductible plans while maintaining financial stability.

Ultimately, the key to successful insurance management is finding the optimal balance between cost savings and financial preparedness. By carefully evaluating deductible options and planning accordingly, individuals can enjoy significant insurance cost reduction while ensuring they are protected against unexpected expenses.

FAQ

What is considered a high deductible?

A high deductible is typically considered to be a deductible amount that is significantly higher than the average deductible for a particular type of insurance plan. For example, in the United States, the IRS defines a high deductible health plan (HDHP) as a plan with a deductible of at least $1,400 for an individual or $2,800 for a family.

How do high deductibles affect insurance premiums?

High deductibles can lead to lower insurance premiums because the insurer is less likely to have to pay out claims. By choosing a higher deductible, you’re essentially taking on more of the financial risk, which can result in lower premium costs.

Are high deductible plans right for everyone?

No, high deductible plans may not be suitable for everyone, particularly those who are prone to frequent medical expenses or have limited financial resources. However, for individuals or families who are relatively healthy and have a financial safety net, high deductible plans can be a cost-effective option.

Can I save money on insurance costs with a high deductible plan?

Yes, many people can save money on insurance costs by opting for a high deductible plan. The amount of savings will depend on various factors, including the type of insurance, the deductible amount, and the premium costs.

What are some strategies to maximize savings with high deductible plans?

To maximize savings with high deductible plans, consider building an emergency fund to cover the deductible, utilizing Health Savings Accounts (HSAs) for tax benefits, and carefully comparing insurance plans to find the most cost-effective option.

How do I determine the optimal deductible level for my insurance needs?

To determine the optimal deductible level, consider your financial situation, health needs, and insurance goals. You may want to weigh the potential savings against the potential out-of-pocket expenses and choose a deductible that balances your needs.

Are there any tax benefits associated with high deductible health plans?

Yes, high deductible health plans (HDHPs) are often paired with Health Savings Accounts (HSAs), which offer tax benefits. Contributions to HSAs are tax-deductible, and the funds can be used tax-free for qualified medical expenses.

Can I switch from a low deductible plan to a high deductible plan?

Yes, you can switch from a low deductible plan to a high deductible plan, but be aware that you may face limitations or penalties, such as losing accumulated funds in a Flexible Spending Account (FSA) or facing a waiting period for a new HSA.