In India, over 37 million vehicles are insured, with the average car insurance premium ranging from 3% to 5% of the vehicle’s showroom price.

Understanding car insurance premium calculation is crucial for vehicle owners to make informed decisions when purchasing or renewing their policies.

The premium calculation takes into account various factors, including the vehicle’s make and model, driver’s age and experience, and location.

By knowing how insurance is calculated for a car, you can better navigate the insurance market and potentially reduce your premium costs.

Understanding Car Insurance Premiums in India

Understanding the intricacies of car insurance premiums is crucial for vehicle owners in India to make informed decisions. Car insurance premiums are the amount paid to an insurance company to maintain coverage for your vehicle.

Types of Car Insurance Policies Available in India

In India, there are primarily two types of car insurance policies: Third-Party Liability Insurance and Comprehensive Car Insurance. Third-Party Liability Insurance is mandatory as per Indian law and covers damages to third-party property or individuals. Comprehensive Car Insurance, on the other hand, provides a broader coverage that includes damages to your vehicle, theft, and third-party liabilities.

- Third-Party Liability Insurance: Covers damages to third-party property or individuals.

- Comprehensive Car Insurance: Covers damages to your vehicle, theft, and third-party liabilities.

Basic Components of a Car Insurance Premium

The basic components that make up a car insurance premium include the Own Damage Premium, Third-Party Liability Premium, and additional costs such as No Claim Bonus and Personal Accident Cover. The Own Damage Premium is calculated based on factors like the vehicle’s value, age, and depreciation.

How Insurance is Calculated for a Car: Key Factors

The calculation of car insurance premiums in India involves several key factors that insurers consider. These factors can be broadly categorized into vehicle-related, driver-related, and policy-related factors.

Vehicle-Related Factors

Vehicle-related factors play a significant role in determining car insurance premiums. These include the make, model, and cubic capacity of the vehicle, its age and condition, and its Insured Declared Value (IDV).

Make, Model and Cubic Capacity

The make, model, and cubic capacity of a vehicle are crucial in determining its insurance premium. Vehicles with higher cubic capacities or those that are expensive to repair or replace tend to have higher premiums. For instance, luxury cars or high-performance vehicles are typically more costly to insure.

Age and Condition of the Vehicle

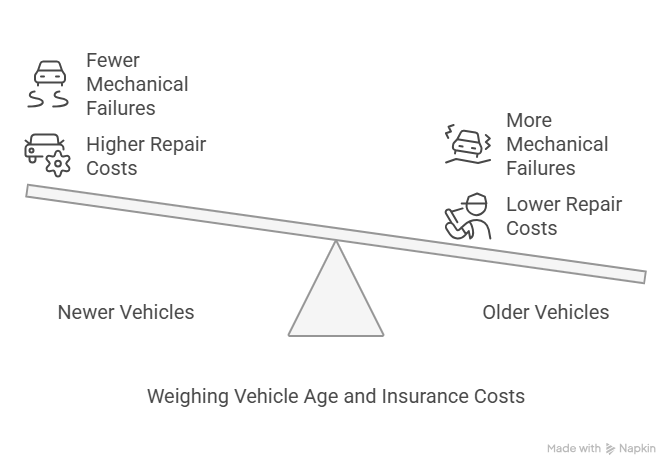

The age and condition of a vehicle also impact its insurance premium. Newer vehicles are generally more expensive to insure because they are costlier to repair or replace. On the other hand, older vehicles may have lower premiums but could be more prone to mechanical failures.

Insured Declared Value (IDV)

IDV is the maximum amount that an insurer will pay in case the vehicle is stolen or damaged beyond repair. The IDV is directly related to the premium amount; a higher IDV results in a higher premium. It’s essential for policyholders to accurately declare the IDV to avoid overpaying or underinsuring their vehicle.

Driver-Related Factors

Driver-related factors also significantly influence car insurance premiums. These include the No Claim Bonus (NCB) and claims history, as well as the age and location of the policyholder.

No Claim Bonus (NCB) and Claims History

NCB is a discount offered to policyholders for not making any claims during the policy period. A higher NCB can lead to lower premiums. Conversely, a history of frequent claims can increase the premium, as it indicates a higher risk to the insurer.

Age and Location of the Policyholder

The age and location of the policyholder are also considered when calculating premiums. Younger drivers or those living in areas with high crime rates or traffic congestion may face higher premiums due to the increased risk.

Policy-Related Factors

Policy-related factors, such as the type of coverage chosen and any add-ons or voluntary deductibles, also impact the premium.

Comprehensive vs. Third-Party Coverage

Comprehensive coverage, which includes both third-party liability and own damage cover, is more expensive than third-party coverage alone. Policyholders who opt for comprehensive coverage pay higher premiums but receive broader protection.

Add-ons and Voluntary Deductibles

Add-ons, such as zero depreciation or engine protection, can enhance the coverage but increase the premium. Voluntary deductibles, on the other hand, can reduce the premium, as the policyholder agrees to pay a certain amount in case of a claim.

| Factor | Description | Impact on Premium |

|---|---|---|

| Make, Model, and Cubic Capacity | Influences repair and replacement costs | Higher cubic capacity or luxury vehicles increase premium |

| IDV | Maximum payout in case of total loss | Higher IDV results in higher premium |

| NCB and Claims History | Reflects driving behavior and risk | Higher NCB reduces premium; frequent claims increase it |

| Type of Coverage | Comprehensive or third-party | Comprehensive coverage is more expensive |

Conclusion: Optimizing Your Car Insurance Premium in India

Understanding how car insurance premiums are calculated is crucial for making informed decisions when purchasing vehicle insurance in India. The key factors influencing car insurance cost breakdown include vehicle-related factors, driver-related factors, and policy-related factors.

To optimize your car insurance premium, it’s essential to choose the right policy that suits your needs. By considering factors such as the type of vehicle, driving history, and coverage limits, you can make informed decisions to lower your vehicle insurance premium calculation.

Insurance companies like ICICI Lombard, HDFC Ergo, and Bajaj Allianz offer various car insurance policies with different premium rates. Comparing these rates and choosing the best policy can help you save on your car insurance premiums. By being aware of the factors that influence car insurance cost breakdown, you can optimize your premium and enjoy comprehensive coverage.

Reference

https://www.youtube.com/@ClearTaxIndia