Did you know that in India, over 4.5 lakh road accidents occur every year, resulting in significant financial losses for many individuals? This staggering statistic highlights the importance of understanding car insurance claims.

Car insurance provides financial protection against unforeseen events like accidents, theft, or natural disasters. However, the frequency of claims allowed within a year is a common concern for policyholders.

Understanding insurance claim eligibility and the number of times you can claim car insurance is crucial for maximizing your benefits. In this article, we will explore the intricacies of car insurance claims in India, helping you make informed decisions about your policy.

Understanding How Many Times Insurance Can Be Claimed in India

In India, understanding the nuances of car insurance claims is crucial for policyholders. The frequency of claims allowed can significantly impact the overall insurance experience.

Technical Limits on Claim Frequency

Technical Limits on Claim Frequency

There are generally no strict technical limits on how many times you can claim car insurance in a year in India. However, insurance companies closely monitor the frequency and nature of claims to prevent fraudulent activities.

Differences Between Comprehensive and Third-Party Coverage

Differences Between Comprehensive and Third-Party Coverage

Comprehensive car insurance covers both third-party damages and damages to your vehicle, allowing for more frequent claims depending on the policy terms. Third-party insurance, on the other hand, covers damages to others, with claim frequency influenced by the number of incidents involving third-party damages.

Indian Insurance Regulatory Framework

The Insurance Regulatory and Development Authority of India (IRDAI) oversees the insurance sector, including car insurance claims. While IRDAI doesn’t specify a limit on claim frequency, it mandates insurance companies to operate fairly and transparently, influencing how claims are processed and settled.

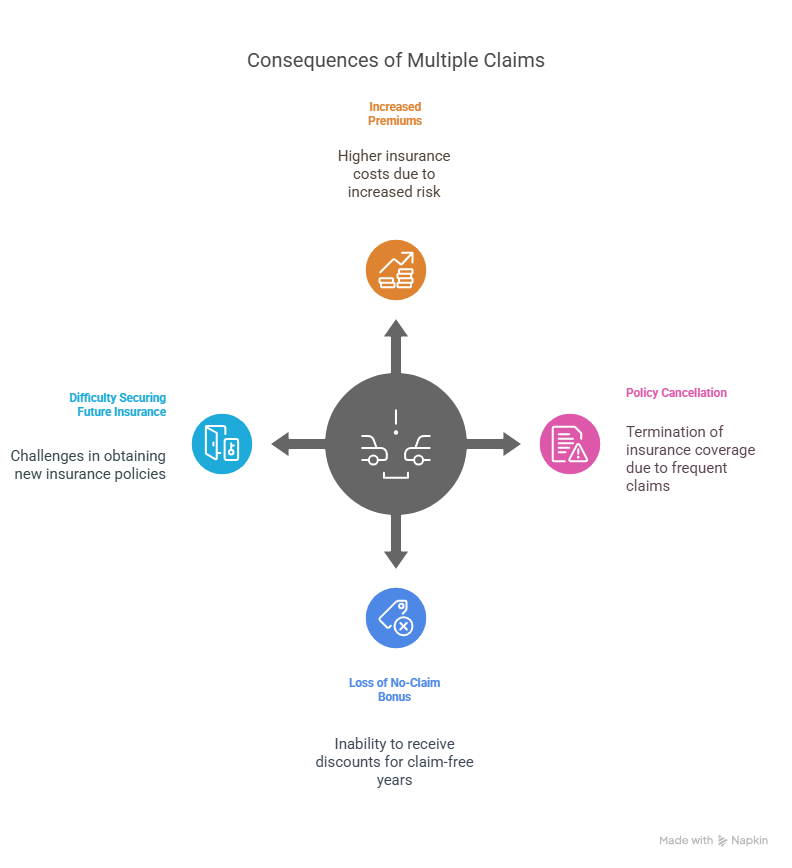

Consequences of Filing Multiple Car Insurance Claims

Making multiple claims on your car insurance can result in several adverse consequences. While having insurance is meant to provide financial security against unforeseen events, frequent claims can negatively impact your policy and financial standing.

Premium Increase After Successive Claims

One of the immediate consequences of filing multiple claims is an increase in your insurance premium. Insurers view policyholders who make frequent claims as higher risk, leading to higher premiums at renewal time. This increase can be substantial, depending on the nature and frequency of the claims.

Loss of No-Claim Bonus Benefits

Filing multiple claims can also result in the loss of your No-Claim Bonus (NCB). The NCB is a discount on your premium for each year you don’t make a claim. Losing this bonus can significantly increase your premium, as it negates the discount you had accumulated over the years.

Potential Policy Non-Renewal Risks

In extreme cases, making multiple claims can lead to the non-renewal of your policy. Insurers may decide not to renew your policy if they deem you too high-risk. This can leave you scrambling to find new insurance, potentially at a much higher cost or with fewer benefits.

Smart Strategies for Managing Car Insurance Claims

Smart strategies are necessary for managing car insurance claims, ensuring policyholders get the best out of their insurance. Effective claim management involves making informed decisions about when to file a claim and how to document it properly.

When to Pay Out-of-Pocket vs. Filing a Claim

It’s essential to weigh the cost of repairs against the potential increase in premiums after filing a claim. For minor damages, paying out-of-pocket might be more economical to avoid premium hikes.

Documentation Requirements for Successful Claims

To ensure a smooth claims process, policyholders must maintain thorough documentation, including:

- Detailed records of the incident

- Photographic evidence of the damage

- Police reports, if applicable

- Repair estimates from authorized garages

Timeline Considerations for Multiple Claims

Policyholders should be aware of the time limits for filing multiple claims. Understanding the insurance reimbursement frequency and the timeline for successive claims can help in planning and avoiding potential complications.

Maximizing Your Car Insurance Benefits

Understanding insurance claims frequency is crucial for car owners in India. By grasping the technical limits on claim frequency, differences between comprehensive and third-party coverage, and the consequences of filing multiple claims, you can make informed decisions about your car insurance.

To maximize your benefits, consider smart strategies such as paying out-of-pocket for minor damages and maintaining thorough documentation for successful claims. Being mindful of insurance claims frequency helps you navigate the Indian insurance regulatory framework effectively.

By adopting a thoughtful approach to car insurance claims, you can minimize premium increases and ensure a smoother claims process.

Reference

https://www.youtube.com/@MyInsuranceClub