In India, the number of vehicles on the road is increasing rapidly, and with it, the importance of having car insurance cannot be overstated. Did you know that as per recent statistics, a significant number of vehicles are being insured online, marking a shift towards digitalization in the insurance sector?

Buying car insurance online offers numerous benefits, including convenience, ease of comparison, and potentially lower premiums. With several insurance providers available online, comparing quotes has become simpler, allowing you to make an informed decision.

Understanding how to compare car insurance quotes online is crucial in securing the right coverage at the best price. This guide will walk you through the process, ensuring you are well-equipped to navigate the online car insurance market in India.

Understanding Car Insurance in India

Understanding car insurance is crucial for Indian car owners to make informed decisions. Car insurance provides financial protection against accidents, theft, and other damages.

Types of Car Insurance Policies Available

There are primarily two types of car insurance policies available in India.

Third-Party Liability Insurance

This is a mandatory insurance type that covers damages to third-party individuals or property.

Comprehensive Car Insurance

Comprehensive car insurance not only covers third-party damages but also provides coverage for your vehicle against theft, natural disasters, and accidents.

Mandatory Insurance Requirements in India

In India, it is compulsory to have at least third-party liability insurance. This requirement is enforced by law to ensure that all vehicle owners can cover the costs of damages to others in case of an accident.

Benefits of Buying Car Insurance Online

Buying car insurance online offers several benefits, including convenience and potentially lower premiums. Online platforms allow you to compare policies from best online car insurance providers easily and buy car insurance online fast.

- Easy comparison of policies

- Convenient purchasing process

- Potential for lower premiums

How to Buy Online Car Insurance: Step-by-Step Process

To buy car insurance online, you need to understand the step-by-step process that ensures a smooth and hassle-free experience. This guide will walk you through the essential steps to find affordable car insurance online.

Research and Compare Insurance Providers

The first step is to research and compare different insurance providers. This involves looking into their reputation, customer service, and the range of policies they offer.

Top Insurance Companies in India

Some of the top insurance companies in India include ICICI Lombard, New India Assurance, and Bajaj Allianz. It’s essential to compare their offerings to find the best policy for your needs.

Documents Required for Online Car Insurance

To complete the online application, you’ll need to provide certain documents.

Vehicle Registration Details

You’ll need your vehicle’s registration details, including the registration number and chassis number.

Personal Information and ID Proof

Additionally, you’ll need to provide personal information and ID proof, such as your PAN card or Aadhaar card.

Completing the Online Application

Once you have all the necessary documents, you can fill out the online application form. Ensure that you provide accurate information to avoid any delays.

Payment and Policy Issuance

After completing the application, you’ll need to make the payment. Most insurance providers offer various payment options for your convenience. Upon successful payment, your policy will be issued, and you’ll receive the policy documents via email.

| Insurance Provider | Policy Features | Premium Cost |

|---|---|---|

| ICICI Lombard | Comprehensive coverage, 24/7 customer support | ₹8,000 – ₹12,000 |

| New India Assurance | Wide range of add-ons, flexible payment options | ₹7,500 – ₹11,000 |

| Bajaj Allianz | Quick claim settlement, personalized support | ₹8,500 – ₹13,000 |

Tips for Finding the Best Car Insurance Deals Online

To get the best car insurance deals online, it’s essential to understand the factors that affect premiums and how to compare them effectively. This knowledge empowers you to make informed decisions when selecting a car insurance policy.

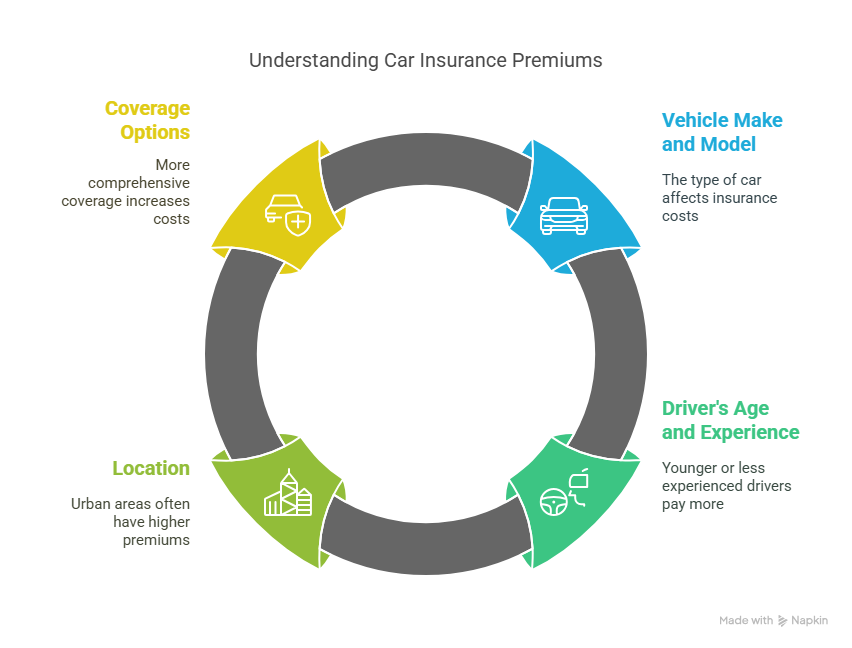

Factors Affecting Car Insurance Premiums in India

Several factors influence car insurance premiums in India, including the vehicle’s make and model, driver’s age and experience, location, and coverage options. Understanding these factors helps you anticipate and manage your insurance costs.

Utilizing Online Comparison Tools

Online comparison tools are invaluable for comparing car insurance quotes from different providers. They save time and help you identify the most competitive offers.

Understanding Add-ons and Riders

Add-ons and riders enhance your car insurance coverage. Key options include:

- Zero Depreciation Cover: Ensures that your vehicle’s depreciation is not deducted when making a claim.

- Roadside Assistance: Provides help in case of a breakdown or accident.

- No Claim Bonus Protection: Safeguards your no-claim bonus even if you make a claim.

Buying Car Insurance Online Made Easy

Now that you’ve learned how to buy online car insurance in India, it’s time to take action. By following the steps outlined in this guide, you can easily compare policies, understand the required documents, and complete your purchase online. Remember to consider factors affecting premiums and utilize online comparison tools to find the best deals.

With numerous insurance providers available, such as Bajaj Allianz and ICICI Lombard, you can choose a policy that suits your needs. By buying car insurance online, you can enjoy a hassle-free experience, save time, and potentially reduce costs. So, take the first step towards securing your vehicle and financial well-being by exploring your options today.

FAQ

What are the benefits of buying car insurance online?

Buying car insurance online offers several benefits, including convenience, potentially lower premiums, and the ability to compare quotes from multiple providers easily. Online platforms also often provide a streamlined application process and quick policy issuance.

How do I compare car insurance quotes online?

To compare car insurance quotes online, you can use comparison tools available on websites or mobile apps of insurance providers or aggregators. You will need to provide some basic information about your vehicle and driving history, and the tool will generate quotes from various insurers.

What documents are required for online car insurance?

The documents required for online car insurance typically include vehicle registration details, personal information, and ID proof. You may also need to provide additional information such as driving history or previous insurance details.

How do I ensure the security of my personal and financial information when buying car insurance online?

To ensure the security of your information, look for online insurance providers that use robust encryption and have a secure payment gateway. Also, be cautious of phishing scams and never share sensitive information via email or unsecured websites.

What is the claim process for online car insurance?

The claim process for online car insurance typically involves reporting the incident to the insurer, providing required documents, and following up with the insurer. Many insurers offer online claim reporting and tracking, making the process more convenient.

Are there any discounts available for online car insurance?

Yes, many insurers offer discounts for online car insurance, such as discounts for purchasing a policy online, having a good driving record, or being a loyal customer. You can check with individual insurers to know about the available discounts.

Can I renew my car insurance policy online?

Yes, most insurers allow you to renew your car insurance policy online. You can log in to your account on the insurer’s website or mobile app, update your information, and pay the premium to renew your policy.

Reference

https://www.qikinsurance.com/third-party-vs-comprehensive-insurance

https://www.qikinsurance.com/how-to-choose-car-insurance