Did you know that car insurance rates in India can vary by as much as 50% depending on several factors? This significant disparity makes it crucial for drivers to understand how to secure the best possible deal on their car insurance. In 2025, the landscape of car insurance continues to evolve, with numerous factors influencing premiums.

To navigate this complex terrain, it’s essential to comprehend the key elements that affect insurance costs. By doing so, you can make informed decisions to minimize your expenses without compromising on coverage. This article will guide you through the process of comparing insurance rates effectively and securing the car insurance best price available in the market.

Understanding Car Insurance Pricing Factors in India

Understanding the intricacies of car insurance pricing factors is crucial for making informed decisions in the Indian insurance market. Car insurance premiums are determined by a complex interplay of various factors that insurers consider when calculating the cost of coverage.

Vehicle-Related Factors

The type of vehicle you own plays a significant role in determining your car insurance premium. Insurers consider several vehicle-related factors, including:

Car Make, Model and IDV

The make and model of your car, along with its Insured Declared Value (IDV), are crucial in determining your premium. Luxury cars or models with high IDVs typically attract higher premiums. For instance, a premium sedan will generally cost more to insure than a standard hatchback.

Vehicle Age and Modifications

The age of your vehicle and any modifications made to it also impact your insurance costs. Older vehicles may have lower premiums due to their decreased value, while modifications, especially those that enhance performance, can increase your premium because they may make your vehicle more attractive to thieves or increase the risk of accidents.

Driver-Related Factors

Your personal profile as a driver also significantly influences your car insurance costs. Insurers assess various driver-related factors, including:

Driving History and Claims Record

A clean driving history with no past claims can lead to lower premiums, as it indicates to insurers that you are a responsible driver. Conversely, a history of accidents or claims can increase your premium, as it suggests a higher risk to the insurer.

Age and Driving Experience

Your age and driving experience are also critical factors. Generally, younger drivers or those with less driving experience are considered higher risk and may face higher premiums. As you gain more experience and mature, your premiums may decrease, reflecting your reduced risk profile.

Policy-Related Factors

The specifics of your car insurance policy also play a crucial role in determining your premium. Key policy-related factors include:

Comprehensive vs. Third-Party Coverage

Choosing between comprehensive and third-party coverage significantly affects your premium. Comprehensive coverage, which includes both third-party liability and damage to your vehicle, is more expensive than third-party coverage alone. However, it provides more extensive protection.

Add-ons and Deductible Amounts

The add-ons you choose and the deductible amounts you select can also impact your premium. Add-ons like zero depreciation or roadside assistance increase your premium, while opting for a higher deductible can lower your premium, as it reduces the insurer’s liability.

By understanding these factors, you can make informed decisions to secure affordable vehicle coverage and achieve the lowest cost car insurance possible in India.

Strategies to Get the Car Insurance Best Price in 2025

The pursuit of the best car insurance deal in 2025 involves leveraging the right tactics and staying informed about the Indian insurance market. As the Indian car insurance landscape continues to evolve, adopting effective strategies can help you secure budget-friendly auto insurance plans that meet your needs.

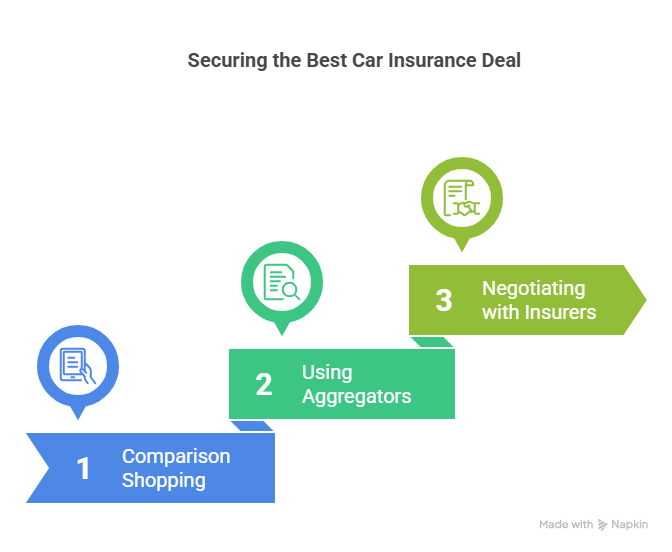

Comparison Shopping in the Indian Market

Comparison shopping is a powerful tool for finding the best car insurance deal. By evaluating quotes from multiple insurers, you can identify the most competitive rates and coverage options.

Using Indian Insurance Aggregators

Indian insurance aggregators simplify the comparison process by providing a platform to view and compare quotes from various insurers. This can save you time and effort in finding the right policy.

Negotiating with Top Indian Insurers

Negotiating with top Indian insurers can also yield better deals. By understanding your insurance needs and shopping around, you can negotiate more effectively.

Maximizing Available Discounts

Maximizing available discounts is another key strategy for reducing your car insurance premiums. Various discounts are available, including no-claim bonus benefits and IRDAI-approved discounts.

No-Claim Bonus Benefits

The no-claim bonus is a significant discount offered by insurers for not making a claim during the policy period. This bonus can substantially reduce your premium at renewal.

IRDAI-Approved Discounts and Offers

IRDAI-approved discounts and offers can provide additional savings. Staying informed about these opportunities can help you lower your insurance costs.

Digital Insurance Options in India

Exploring digital insurance options can provide more tailored and cost-effective coverage. Options like pay-as-you-drive policies and telematics-based insurance are becoming increasingly popular.

Pay-As-You-Drive Policies

Pay-as-you-drive policies charge premiums based on your actual vehicle usage, potentially offering significant savings for low-mileage drivers.

Telematics and Usage-Based Insurance

Telematics and usage-based insurance use technology to monitor driving habits, offering discounts for safe driving practices.

Timing Your Purchase

Timing your car insurance purchase wisely can also help you save money. Understanding seasonal rate variations and following policy renewal best practices are crucial.

Seasonal Rate Variations in India

Seasonal rate variations can impact your insurance premiums. Being aware of these fluctuations can help you plan your purchase accordingly.

Policy Renewal Best Practices

Following policy renewal best practices, such as reviewing your coverage and comparing quotes, can ensure you’re getting the best deal at renewal.

Conclusion

To secure the best car insurance price in 2025, understanding the pricing factors and minimizing costs is crucial. Being informed helps you get affordable coverage that suits your needs. Regular policy reviews ensure you’re getting discounted car insurance premiums.

By comparing insurance options, leveraging discounts, and opting for digital insurance, you can obtain cheap auto insurance quotes. This proactive approach enables you to enjoy budget-friendly car insurance, providing the necessary vehicle protection.

Reference

https://www.youtube.com/@MyInsuranceClub