“The biggest risk is not taking any risk…” These words by Mark Zuckerberg underscore the importance of being informed, especially when it comes to something as critical as car insurance. Understanding the intricacies of your policy can be the difference between being adequately covered or facing financial hardship in the event of an unforeseen circumstance.

For every car owner in India, grasping the terms and conditions of their insurance is not just a matter of compliance; it’s a crucial step towards making informed decisions. With numerous options available and legal requirements to adhere to, it’s essential to know what you’re signing up for.

By understanding these critical aspects, you’ll be better equipped to navigate the complexities of insurance policies and ensure you’re getting the coverage you need.

Essential Car Insurance Terms and Conditions for Indian Drivers

As an Indian driver, being informed about the vital aspects of motor insurance terms overview can significantly impact your financial security on the road. Understanding these terms is crucial for making informed decisions when purchasing or renewing your car insurance.

Third-Party Liability vs. Comprehensive Coverage

Third-party liability covers damages to others in an accident, while comprehensive coverage includes damages to your vehicle. The latter provides broader protection but at a higher premium. It’s essential to weigh the benefits of each when choosing your vehicle coverage agreements.

Motor Vehicles Act Requirements in India

The Motor Vehicles Act in India mandates third-party liability insurance for all vehicles. This requirement ensures that drivers can cover damages to others in case of an accident. Understanding these requirements is vital to avoid legal complications.

Policy Period and Grace Period for Renewals

Your policy period is the duration for which your car insurance is valid. It’s crucial to renew your policy before it expires. Many insurers offer a grace period for renewals, allowing you some flexibility in case you miss the renewal deadline. Be aware of these timelines to maintain continuous coverage and avoid lapses in your auto insurance policy fine print.

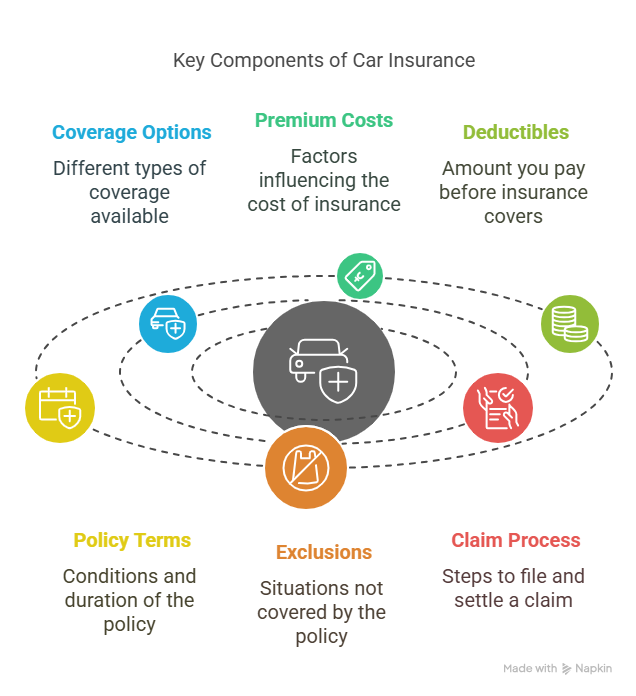

Critical Policy Components That Determine Your Protection

The effectiveness of your car insurance policy hinges on several critical components that you need to be aware of. Understanding these elements can help you make informed decisions about your coverage and ensure you’re adequately protected on the road.

Insured Declared Value (IDV) Calculation

The Insured Declared Value (IDV) is a crucial aspect of your car insurance policy. It represents the maximum amount you’ll receive if your vehicle is stolen or suffers a total loss. IDV calculation is based on the vehicle’s market value, taking into account depreciation and other factors.

Factors Affecting IDV Assessment

Several factors influence IDV assessment, including the vehicle’s age, condition, and market value. Depreciation plays a significant role in determining IDV.

IDV Impact on Premium and Claims

IDV directly affects your premium and claims. A higher IDV results in a higher premium, while a lower IDV means lower premiums but also lower claim payouts.

Deductibles: Compulsory and Voluntary

Deductibles are amounts you must pay out-of-pocket when making a claim. Compulsory deductibles are mandatory, while voluntary deductibles are optional. Choosing a higher deductible can lower your premium.

No-Claim Bonus (NCB) Benefits and Transfer Rules

The No-Claim Bonus (NCB) is a reward for not making claims during a policy period. It offers a discount on your premium. NCB benefits include lower premiums, and it’s transferable to new policies or even to a different insurer under certain conditions.

Understanding Car Insurance Terms and Conditions: Exclusions and Limitations

Understanding the fine print of your car insurance policy is essential to avoid surprises during claims. Car insurance policies in India come with specific exclusions and limitations that can significantly impact your coverage.

Standard Policy Exclusions in Indian Market

Car insurance policies in India typically exclude certain scenarios, including driving without a valid license or under the influence of alcohol or drugs. It’s essential to understand these exclusions to avoid claim rejections.

Driving Without Valid License or Under Influence

Driving without a valid license or under the influence is a significant exclusion in most car insurance policies. If you’re involved in an accident while driving under the influence, your claim may be rejected.

Consequential Damage and Wear and Tear

Consequential damage, such as wear and tear, is generally not covered under standard car insurance policies. This means that damages resulting from regular use or aging of vehicle parts may not be claimable.

Geographical Limitations

Most car insurance policies in India have geographical limitations. For instance, some policies may not cover damages or losses incurred while driving abroad or in certain restricted areas.

Essential Add-on Covers for Complete Protection

To enhance your car insurance coverage, consider adding optional covers that provide additional protection. These add-ons can help fill the gaps left by standard policy exclusions.

Zero Depreciation Cover

The Zero Depreciation Cover ensures that you receive the full claim amount without considering depreciation on parts. This add-on is particularly useful for new vehicles.

Engine Protection and Roadside Assistance

Engine Protection and Roadside Assistance are valuable add-ons that cover engine damage due to water logging or other reasons and provide help during breakdowns, respectively.

Return to Invoice and Consumables Cover

The Return to Invoice Cover reimburses you for the difference between the Insured Declared Value (IDV) and the invoice price if your car is stolen or damaged beyond repair. Consumables Cover includes the cost of consumables like engine oil or other fluids that may need replacement following an accident.

| Add-on Cover | Description | Benefits |

|---|---|---|

| Zero Depreciation Cover | Covers full claim amount without depreciation | Useful for new vehicles |

| Engine Protection | Covers engine damage due to water logging or other reasons | Protects against costly engine repairs |

| Roadside Assistance | Provides help during breakdowns | Ensures timely assistance on the road |

Conclusion

Understanding car insurance terms and conditions is crucial for Indian drivers to make informed decisions when purchasing motor insurance. By grasping the nuances of motor insurance terms overview, car owners can ensure they have the right coverage for their needs.

A clear comprehension of policy components, such as Insured Declared Value (IDV) and No-Claim Bonus (NCB), can help policyholders optimize their car insurance benefits. Being aware of standard policy exclusions and optional add-on covers can also enhance their protection.

By familiarizing themselves with car insurance terms and conditions, Indian car owners can navigate the complexities of motor insurance and make the most of their policies. This knowledge empowers them to drive with confidence, knowing they are adequately protected against unforeseen events.

FAQ

What is the difference between third-party liability and comprehensive coverage in car insurance?

Third-party liability coverage is mandatory in India and covers damages to others in an accident, while comprehensive coverage includes third-party liability and also covers damages to your vehicle, providing more extensive protection.

What is Insured Declared Value (IDV) and how is it calculated?

IDV is the maximum amount your insurance company will pay in case of theft or total loss of your vehicle. It’s calculated based on the vehicle’s market value, depreciation, and other factors, and affects your premium and claims.

What is the No-Claim Bonus (NCB) and how does it benefit me?

NCB is a discount on your premium for not making any claims during the policy period. It encourages safe driving and can be transferred to a new policy or insurer, providing a significant reduction in your premium.

What are the standard exclusions in a car insurance policy?

Standard exclusions include driving without a valid license, under the influence of alcohol or drugs, consequential damage, wear and tear, and geographical limitations. Understanding these exclusions can help you avoid surprises during claims.

What are add-on covers, and how can they enhance my car insurance policy?

Add-on covers are additional features you can include in your policy to enhance protection, such as zero depreciation cover, engine protection, roadside assistance, and return to invoice cover. They provide extra benefits and can be tailored to your specific needs.

How does the policy period and grace period for renewals work?

The policy period is the duration of your car insurance coverage, usually one year. The grace period is the time allowed after the policy expires to renew it without a lapse in coverage, typically ranging from 15 to 30 days.

What is the impact of deductibles on my car insurance premium and claims?

Deductibles are amounts you must pay out-of-pocket when making a claim. Higher deductibles can lower your premium, but you’ll pay more in case of a claim. Understanding the balance between deductibles and premiums is crucial for managing your insurance costs.

Reference