Did you know that insuring multiple vehicles under a single policy can lead to significant discounts? This practice is a savvy way to save on car coverage. By bundling your vehicles, you can enjoy substantial savings and simplify your insurance management.

Families and individuals with multiple vehicles can benefit greatly from multi-car insurance deals. Not only do you save money, but you also streamline your insurance process by having all your vehicles under one policy. This means less paperwork and fewer things to keep track of, making it a convenient option for those with multiple cars.

Understanding how multi-vehicle insurance savings work is key to unlocking these benefits. Let’s explore how you can make the most of this opportunity.

Understanding Multi-Vehicle Insurance Savings

Insuring multiple vehicles under a single policy can lead to substantial bundle auto insurance savings. This approach not only simplifies your insurance management but also reduces your overall insurance costs.

What Qualifies as a Multi-Vehicle Policy

A multi-vehicle policy typically involves insuring two or more vehicles under the same insurance provider. To qualify, the vehicles are usually required to be registered to the same household or individual. Some insurance companies may have specific requirements, such as the vehicles being garaged at the same location.

Types of Vehicles You Can Include

Most insurance providers allow you to include a variety of vehicles under a multi-vehicle policy, such as:

- Cars

- Trucks

- SUVs

- Motorcycles

- RVs (Recreational Vehicles)

It’s essential to check with your insurance provider to see which types of vehicles are eligible for multi-vehicle coverage.

Average Discount Percentages in the United States

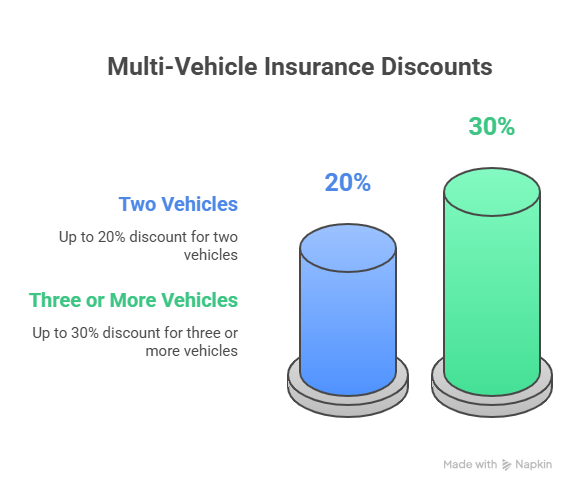

The average discount for multi-vehicle insurance policies can vary significantly across different insurance companies and states. However, on average, policyholders can expect to save between 10% to 25% on their insurance premiums. Some of the top insurance providers offer:

- Up to 20% discount for insuring two vehicles

- Up to 30% discount for insuring three or more vehicles

These multi-policy insurance benefits can add up, making it a worthwhile strategy for households with multiple vehicles.

By understanding the intricacies of multi-vehicle insurance and taking advantage of the available discounts, you can enjoy significant multi-vehicle coverage discounts, making your insurance coverage more affordable.

Maximizing Your Multi-Vehicle Discount Benefits

Maximizing your multi-vehicle discount benefits requires a strategic approach to insurance coverage. By understanding how to apply for multi-vehicle coverage, combining it with other available discounts, and comparing providers, you can enjoy significant savings on your insurance premiums.

How to Apply for Multi-Vehicle Coverage

Applying for multi-vehicle coverage is typically straightforward. Start by contacting your current insurance provider to inquire about their multi-vehicle discount policies. Most insurance companies offer discounts for insuring multiple vehicles under the same policy. You’ll need to provide details about the vehicles you want to insure, including their make, model, and Vehicle Identification Number (VIN).

It’s also essential to review your existing policy to ensure that all drivers and vehicles are included. Some insurance companies may require all vehicles to be registered to the same address, so be sure to check the specific requirements of your provider.

Combining with Other Available Discounts

To further reduce your insurance premiums, consider combining your multi-vehicle discount with other available discounts. Many insurance providers offer discounts for things like safe driving, bundling policies, and being a good student. Ask your insurance provider about any additional discounts you might be eligible for.

- Safe driver discounts

- Multi-policy discounts

- Good student discounts

- Low-mileage discounts

Comparing Providers for the Best Multi-Vehicle Rates

Comparing insurance providers is crucial to finding the best multi-vehicle rates. Use online comparison tools or consult with an insurance broker to get quotes from multiple companies. When comparing rates, be sure to consider not just the premium cost but also the coverage limits, deductibles, and any exclusions.

Some of the top insurance companies for multi-car policies include:

| Insurance Company | Average Discount | Maximum Discount |

|---|---|---|

| State Farm | 10% | 20% |

| Geico | 12% | 25% |

| Allstate | 15% | 30% |

Potential Limitations and Exclusions

While multi-vehicle discounts can offer significant savings, there are potential limitations and exclusions to be aware of. Some insurance companies may have restrictions on the types of vehicles that can be included or may require certain safety features. Review the terms and conditions of your policy carefully to understand any limitations.

Conclusion

By now, it’s clear that multi-vehicle insurance discounts can significantly reduce your insurance costs. To recap, understanding what qualifies as a multi-vehicle policy and the types of vehicles you can include is crucial for maximizing your savings.

When you combine multiple vehicles under one policy, you not only simplify your insurance management but also benefit from substantial discounts. Providers like Geico and State Farm offer competitive multi-vehicle insurance rates, making it easier to save.

To take full advantage of multi-vehicle insurance savings, compare providers, and explore additional discounts you may be eligible for. By doing so, you’ll be able to enjoy the benefits of reduced premiums while maintaining comprehensive coverage for all your vehicles.

Start exploring your multi-vehicle insurance options today and experience the ease of managing your insurance needs while saving money.

FAQ

What is a multi-vehicle insurance discount?

A multi-vehicle insurance discount is a reduction in your insurance premium when you insure multiple vehicles under a single policy with the same insurance provider.

How do I qualify for a multi-vehicle insurance discount?

To qualify, you typically need to insure at least two vehicles under the same policy with the same insurance company. The specific requirements may vary depending on the insurer.

Can I include different types of vehicles in a multi-vehicle policy?

Yes, many insurance companies allow you to include various types of vehicles, such as cars, trucks, SUVs, and motorcycles, in a multi-vehicle policy. However, it’s best to check with your insurer for specific details.

How much can I save with a multi-vehicle insurance discount?

The average discount percentage for multi-vehicle insurance varies among insurance companies, but you can typically expect to save between 5% to 25% on your overall premium.

Can I combine a multi-vehicle discount with other insurance discounts?

Yes, many insurance providers allow you to combine a multi-vehicle discount with other discounts, such as safe driver discounts or bundle discounts, to maximize your savings.

Are there any limitations or exclusions to multi-vehicle insurance discounts?

Some insurance companies may have limitations or exclusions, such as requiring all vehicles to be registered to the same address or having a minimum number of vehicles on the policy. It’s essential to review the terms and conditions with your insurer.

How do I compare multi-vehicle insurance rates among different providers?

To compare rates, you can request quotes from multiple insurance companies, either directly or through online comparison tools, and evaluate the discounts and coverage options they offer for multi-vehicle policies.

Can I get a multi-vehicle insurance discount if I have a non-standard insurance policy?

Some insurance companies may offer multi-vehicle discounts for non-standard insurance policies, but the availability and terms may vary. It’s best to check with your insurer or shop around for quotes.