Did you know that nearly 44% of renters in the United States don’t have insurance to protect their personal belongings?

This staggering statistic highlights a significant gap in financial protection for many individuals. As a renter or condo owner, understanding the differences between renter’s and condo insurance is crucial for making informed decisions about your financial security.

The distinction between these two types of insurance policies can be confusing, but it’s essential to know what’s at stake. In this article, we’ll explore the key differences and help you determine which type of insurance is right for you.

Understanding the Basics of Renters and Condo Insurance

To make informed decisions about your insurance, it’s vital to grasp the basics of both renters and condo insurance. Insurance policies for renters and condo owners are designed to protect against different types of risks.

What is Renters Insurance?

Renters insurance, also known as apartment insurance coverage, protects tenants against losses to their personal property and provides liability coverage in case someone is injured in the rental property. It covers what is typically not covered by the landlord’s insurance, which usually only covers the building itself. Apartment insurance coverage includes protection for personal belongings against theft, fire, and other damages.

Understanding what is covered by renters insurance is crucial. Typically, it includes personal property coverage, liability protection, and additional living expenses in case the rental becomes uninhabitable due to a covered loss.

What is Condo Insurance?

Condo insurance is designed for condominium owners and covers the interior of the condo unit, including personal property, improvements made to the unit, and liability. It differs from renters insurance because it covers the physical structure of the condo unit, not just the contents. Condo insurance also typically includes a portion that covers the owner’s share of the common elements of the condo complex.

A Complete Renters vs Condo Insurance Breakdown

To make an informed decision, it’s essential to dive into the specifics of renters and condo insurance. While both types provide financial protection, they cater to different needs and circumstances.

Property Coverage Differences

The primary distinction lies in what each insurance type covers. Here’s a breakdown:

Personal Property Protection

Both renters and condo insurance cover personal belongings against damage or theft. However, the extent of coverage can vary based on the policy and insurer.

Structural Coverage Distinctions

Condo insurance typically covers the interior structure of the condo unit, including fixtures and improvements. In contrast, renters insurance does not cover the building itself, as that’s usually the landlord’s responsibility.

Liability Protection Comparison

Both renters and condo insurance offer liability protection, which covers you if someone is injured in your rental or condo. However, the coverage limits and conditions may differ.

- Renters insurance typically covers liability for accidents within the rental unit.

- Condo insurance may also cover liability for accidents in common areas, depending on the policy.

Additional Living Expenses Coverage

If your rental or condo becomes uninhabitable due to damage, both insurance types can cover additional living expenses, such as hotel stays or temporary rentals. The key is understanding the coverage limits and what’s included.

When comparing condo insurance comparison and renters insurance, consider your specific needs and the level of coverage required. Understanding these differences can help you make an informed decision and ensure you’re adequately protected.

Cost Factors and Policy Considerations

Understanding the cost factors and policy considerations is crucial when deciding between renters and condo insurance. The financial implications of choosing the wrong insurance can be significant, making it vital to compare your options carefully.

Average Costs for Renters Insurance

The average cost of renters insurance in the United States is relatively affordable, typically ranging from $15 to $30 per month, depending on several factors including location, coverage limits, and deductible amounts. For instance, renters in areas prone to natural disasters may pay more for their insurance. To find the best insurance for renters, it’s essential to shop around and compare quotes from different providers.

Typical Condo Insurance Premiums

Condo insurance premiums can vary more widely than renters insurance, as they often cover not just personal property and liability but also parts of the condo unit itself. On average, condo insurance can cost between $30 to $100 per month. The specifics of a condo insurance policy, including what is covered and the deductible amounts, can significantly impact the premium costs.

Coverage Limits and Deductibles

Both renters and condo insurance policies involve choosing coverage limits and deductibles. Higher coverage limits provide more comprehensive protection but at a higher cost. Similarly, lower deductibles mean less out-of-pocket expense in case of a claim but result in higher premiums. It’s crucial to strike a balance that fits your financial situation and risk tolerance.

Factors That Affect Insurance Rates

Several factors can affect insurance rates for both renters and condo owners, including the location of the property, the value of the personal property being insured, the deductible chosen, and even the insurance company’s own pricing algorithms. Understanding these factors can help you make informed decisions to potentially lower your insurance costs.

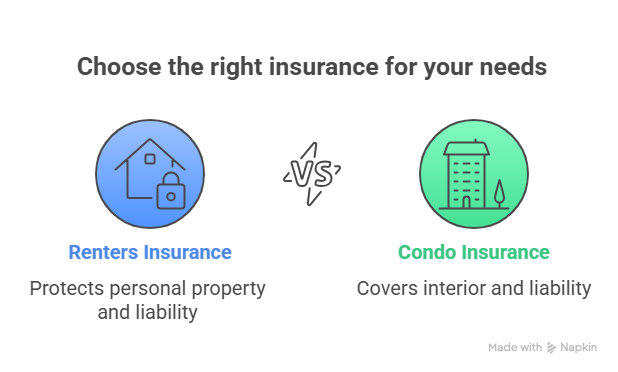

Conclusion: Choosing the Right Insurance for Your Situation

Understanding the differences between renters and condo insurance is crucial for making an informed decision about your insurance needs. While both types of insurance provide protection against various risks, condo insurance offers additional benefits, such as coverage for the interior structure of your condo unit, which can be a significant condo insurance benefit.

When considering renters insurance, it’s essential to evaluate your renters insurance coverage limits to ensure you have adequate protection for your personal belongings and liability. On the other hand, condo insurance typically covers the unit’s interior, including fixtures and improvements.

To choose the right insurance for your situation, assess your individual circumstances, including the value of your personal property, your liability exposure, and any additional living expenses you may incur in case your home becomes uninhabitable. By carefully evaluating these factors and understanding the benefits and limitations of each type of insurance, you can make an informed decision that provides you with peace of mind and financial protection.

FAQ

What is the main difference between renters and condo insurance?

The primary difference lies in the type of property and coverage. Renters insurance covers personal belongings and liability for renters, while condo insurance covers the condo unit, personal belongings, and liability for condo owners.

Does renters insurance cover damage to the rental property?

No, renters insurance typically does not cover damage to the rental property itself. It covers the renter’s personal property and liability. The landlord is usually responsible for insuring the building.

What is covered under condo insurance?

Condo insurance typically covers the condo unit, including improvements made to the unit, personal property, and liability. It may also cover additional living expenses if the condo becomes uninhabitable due to a covered loss.

How do I determine the right coverage limits for my renters or condo insurance?

To determine the right coverage limits, consider the value of your personal belongings, potential liability risks, and any specific requirements from your landlord or condo association. You can also consult with an insurance professional for guidance.

Can I get a discount on my renters or condo insurance?

Yes, many insurance companies offer discounts for various reasons, such as having multiple policies with the same insurer, installing security systems, or being a non-smoker. It’s best to check with your insurance provider to see what discounts are available.

How do I choose the best insurance for my rental or condo?

When choosing the best insurance, consider factors such as coverage limits, deductibles, premium costs, and the insurance company’s reputation. You should also review the policy details and ask questions to ensure you understand what’s covered.

What factors affect the cost of renters and condo insurance?

Factors that affect the cost include the location, value of personal property, coverage limits, deductibles, and the insurance company’s rates. Additionally, condo insurance costs can be influenced by the condo association’s master policy and the unit’s specific characteristics.