Did you know that nearly 1 in 5 drivers on the road today is a senior citizen? As people age, their insurance needs change, and many insurance companies offer special discounts for senior drivers to help reduce their premiums.

These discounts can be a significant way for seniors to save money on their car insurance. With the rising costs of living, it’s essential for seniors to take advantage of every opportunity to lower their expenses.

By understanding and claiming these discounts, seniors can enjoy lower insurance rates. It’s crucial to explore the various discounts available and determine which ones you qualify for.

Understanding Senior Driver Insurance Discounts

Senior drivers can significantly reduce their insurance costs by leveraging available discounts. As drivers age, they often become eligible for various discounts on their insurance premiums.

Age-Based Discount Programs

Many insurance companies offer discounts to drivers once they reach a certain age, typically 50 or 55. These age-based discount programs recognize that older drivers tend to be more cautious and have more driving experience.

AARP and Organization-Based Savings

Membership in organizations like AARP can also qualify seniors for exclusive discounts. These organizations often partner with insurance providers to offer discounted rates to their members.

How Much Can Seniors Save?

The amount seniors can save varies by insurance provider and the specific discounts available. However, seniors can potentially save hundreds of dollars annually by combining multiple discounts.

| Discount Type | Average Savings | Eligibility Criteria |

|---|---|---|

| Age-Based Discount | $100-$200 annually | Ages 50+ |

| AARP Membership Discount | $150-$300 annually | AARP members aged 50+ |

| Defensive Driving Course Discount | $50-$150 annually | Completion of a defensive driving course |

By understanding and leveraging these discounts, seniors can make informed decisions about their insurance and potentially lower their premiums.

Top Senior Driver Insurance Discounts to Claim

Senior drivers can significantly lower their insurance premiums by exploring and claiming the right discounts. As people age, they become eligible for various discounts that can lead to substantial savings on their car insurance.

Defensive Driving Course Discounts

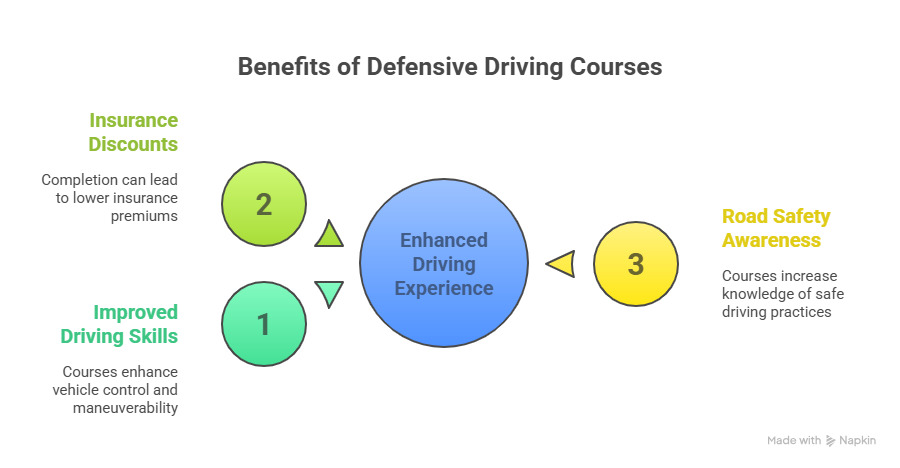

One of the most effective ways for seniors to save on their car insurance is by taking a defensive driving course. These courses help improve driving skills and are often recognized by insurance companies as a sign of reduced risk. Upon completion, seniors can qualify for discounts on their premiums. Many states offer such courses, and they are usually available online or in-person.

Benefits of Defensive Driving Courses:

- Improved driving skills

- Potential for insurance discounts

- Enhanced road safety awareness

Low Mileage and Usage-Based Savings

Seniors who drive fewer miles are considered lower risk by insurance companies. Low mileage discounts are available for those who drive less than a certain number of miles per year. Additionally, usage-based insurance programs track driving habits and can offer discounts for safe driving practices.

| Low Mileage Threshold | Average Discount |

|---|---|

| Less than 7,000 miles/year | 5% discount |

| Less than 5,000 miles/year | 10% discount |

Vehicle Safety Feature Discounts

Vehicles equipped with advanced safety features can qualify for insurance discounts. Features such as anti-lock brakes, airbags, and electronic stability control are considered safety enhancements. Seniors driving vehicles with these features may be eligible for reduced premiums.

Examples of Safety Features:

- Anti-lock braking system (ABS)

- Multiple airbags

- Electronic stability control

Loyalty and Bundling Opportunities

Loyalty discounts are offered by insurance companies to long-term customers. Seniors who have been with the same insurer for several years can benefit from these discounts. Additionally, bundling multiple insurance policies (such as home and auto) with the same company can lead to significant savings.

By exploring these options, seniors can significantly reduce their insurance costs. It’s essential to consult with insurance providers to determine the specific discounts available based on individual circumstances.

Conclusion

As a senior driver, you have numerous opportunities to save on your insurance premiums. By understanding and claiming the available retired driver insurance discounts, you can significantly lower your insurance costs. Safe driver discounts for seniors are designed to reward responsible driving habits, and exploring these options can lead to substantial savings.

To make the most of these discounts, it’s essential to review your current insurance policy and inquire about the available discounts. Many insurance providers, such as those offering AARP discounts, have programs in place to help seniors save on their premiums. By taking advantage of defensive driving course discounts, low mileage savings, and vehicle safety feature discounts, you can enjoy lower insurance rates.

By being proactive and exploring the available options, you can maximize your savings and enjoy more affordable insurance premiums. Take the first step today and start saving on your insurance premiums by claiming the senior driver insurance discounts you’re eligible for.

FAQ

What are senior driver insurance discounts?

Senior driver insurance discounts are special reductions in insurance premiums offered to drivers who have reached a certain age, typically 50 or 55, by insurance companies.

How do I qualify for senior driver insurance discounts?

To qualify, you usually need to be a certain age, have a clean driving record, or be a member of specific organizations like AARP. Some insurers also offer discounts for completing defensive driving courses.

Can taking a defensive driving course really lower my insurance premiums?

Yes, many insurance companies offer discounts to seniors who complete a defensive driving course, as it helps improve driving skills and reduces the risk of accidents.

Are there discounts available for low-mileage drivers?

Yes, some insurance companies offer low-mileage discounts or usage-based insurance that can save seniors money if they drive fewer miles.

How can being an AARP member help with insurance discounts?

AARP members can qualify for exclusive insurance discounts through partnerships with insurance providers, offering savings on premiums.

Can I bundle my insurance policies to get a discount as a senior?

Yes, bundling multiple insurance policies with the same provider can often result in discounts, a benefit available to seniors as well as other customers.

Are there vehicle safety feature discounts available for seniors?

Yes, many insurers offer discounts for vehicles equipped with certain safety features, which can be beneficial for seniors who own newer or safer vehicles.

How much can I save with senior driver insurance discounts?

Savings vary by insurer and the specific discounts you’re eligible for, but seniors can potentially save a significant amount on their insurance premiums by claiming these discounts.

Do all insurance companies offer senior driver insurance discounts?

Not all insurance companies offer the same discounts, so it’s essential to check with your insurer to see what senior discounts are available.