“Risk comes from not knowing what you’re doing.” – Warren Buffett. This quote resonates deeply with the concept of car insurance, a crucial aspect of responsible vehicle ownership.

In today’s fast-paced world, securing the right car insurance can be daunting. However, with Tata AIG’s online car insurance solutions, you can now safeguard your vehicle with ease.

Tata AIG’s car insurance online platform offers a seamless experience, allowing you to explore features, benefits, and purchase policies conveniently. By choosing Tata AIG, you’re opting for a trusted brand that understands your needs.

Let’s explore the key features and benefits of Tata AIG’s car insurance and understand how to buy it online.

Understanding Tata AIG Car Insurance in India

Tata AIG Car Insurance is a prominent player in India’s insurance market, offering a range of policies to suit different needs. With a strong presence in the country, Tata AIG General Insurance Company has established itself as a reliable provider of car insurance.

About Tata AIG General Insurance Company

Tata AIG General Insurance Company is a joint venture between Tata Sons Ltd. and American International Group (AIG). With a rich history and a strong mission to provide innovative insurance solutions, the company has built a reputation for reliability and customer-centric services. Some key aspects of the company include:

- Financial Stability: Backed by the financial strength of its parent companies.

- Innovative Products: Offers a range of insurance products tailored to meet the evolving needs of customers.

- Customer Support: Provides robust customer support through various channels.

Types of Car Insurance Policies Offered

Tata AIG offers various types of car insurance policies to cater to the diverse needs of vehicle owners in India. The primary types of policies include:

- Comprehensive Car Insurance: Covers damages to the insured vehicle, third-party liabilities, and personal accident cover.

- Third-Party Car Insurance: Mandatory as per Indian law, it covers liabilities towards third-party damages or injuries.

These policies can be further customized with add-on covers to enhance protection.

Key Features and Benefits of Online Car Insurance Tata AIG

Tata AIG’s online car insurance is designed to provide extensive coverage and convenience. With a range of features and benefits, it’s no wonder that many choose Tata AIG for their car insurance needs.

Comprehensive Coverage Options

Tata AIG offers comprehensive coverage options that protect against various types of damages, including accidents, theft, and natural disasters. The coverage is extensive, ensuring that policyholders have peace of mind on the road.

Add-on Covers and Riders

In addition to the standard coverage, Tata AIG provides add-on covers and riders that can be purchased to enhance the policy. These include benefits like zero depreciation cover and roadside assistance, making the insurance more comprehensive.

Cashless Claims at Network Garages

One of the significant advantages of Tata AIG’s online car insurance is the convenience of cashless claims at network garages. This feature ensures that policyholders can get their vehicles repaired without the hassle of upfront payments.

Digital Tools and Customer Support

Tata AIG also offers digital tools and customer support to make managing the insurance policy easier. From online claim filing to 24/7 customer support, Tata AIG ensures that policyholders have a smooth experience.

| Feature | Description | Benefit |

|---|---|---|

| Comprehensive Coverage | Covers damages from accidents, theft, and natural disasters | Peace of mind on the road |

| Add-on Covers | Optional benefits like zero depreciation cover and roadside assistance | Enhanced policy coverage |

| Cashless Claims | Claims processed without upfront payment at network garages | Convenience and reduced financial burden |

To get tata aig car insurance quote or learn more about the best car insurance tata aig online offers, visiting their official website is the best step. Tata AIG’s tata aig vehicle insurance online platform is designed to be user-friendly, making it easy to purchase and manage your car insurance policy.

How to Buy Tata AIG Motor Insurance Online

Buying Tata AIG motor insurance online is a straightforward process that can be completed in a few simple steps. The online platform is designed to provide a seamless experience, allowing you to compare and purchase the right policy for your vehicle.

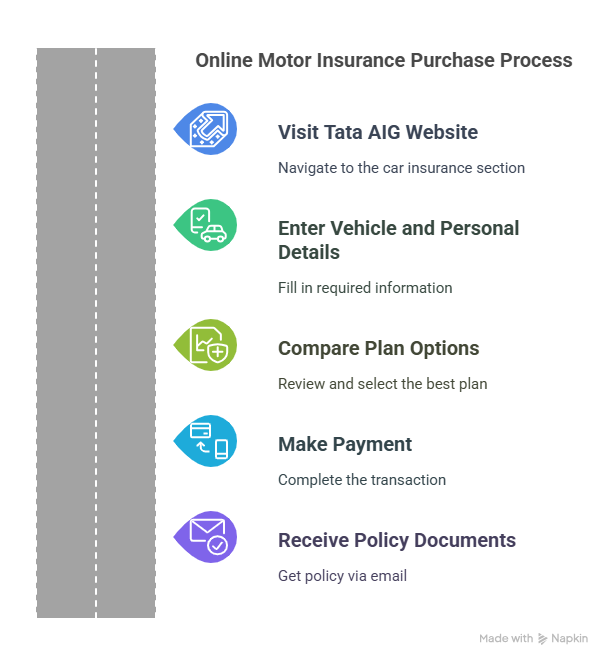

Step-by-Step Purchase Process

To buy Tata AIG car insurance online, start by visiting the Tata AIG website and navigating to the car insurance section. Fill in the required details, including your vehicle information and personal details. You will then be presented with various plan options to choose from, allowing you to compare Tata AIG car insurance online plans and select the one that best suits your needs.

Once you’ve chosen your plan, proceed to pay the premium using one of the available payment options. After successful payment, you will receive your policy documents via email.

Documents Required for Online Purchase

When purchasing online motor insurance Tata AIG, you will need to provide certain documents, including your vehicle’s registration certificate, driving license, and previous insurance policy details (if applicable). Ensure you have these documents readily available to facilitate a smooth online purchase process.

Payment Options and Discounts

Tata AIG offers various payment options for your convenience, including net banking, credit/debit cards, and UPI. Additionally, you may be eligible for discounts, such as no-claim bonuses or loyalty discounts, which can reduce your premium.

Policy Renewal Process

Renewing your Tata AIG car insurance online is easy. You will receive a renewal notice before your policy expires, and you can renew online by following a similar process to the initial purchase. Ensure you renew on time to avoid any lapses in coverage.

Conclusion

Buying car insurance online has become a hassle-free experience with Tata AIG. The online car insurance tata aig offers comprehensive coverage options, add-on covers, and cashless claims at network garages, making it a preferred choice for many.

With tata aig motor insurance online, you can enjoy a seamless purchase process, flexible payment options, and discounts on your premium. The digital tools and customer support provided by Tata AIG ensure that you have a smooth experience throughout your policy tenure.

By choosing Tata AIG car insurance, you can drive with confidence, knowing that you are protected against unforeseen events. Explore the options available and make an informed decision when selecting a car insurance policy that suits your needs.

FAQ

What is the process of buying Tata AIG car insurance online?

To buy Tata AIG car insurance online, simply visit the Tata AIG website, fill in the required details, choose your policy, make the payment, and receive your policy documents via email or download them from the website.

What are the benefits of buying Tata AIG motor insurance online?

Buying Tata AIG motor insurance online offers several benefits, including convenience, ease of comparison, and potential discounts. You can also avoid agent commissions and get instant policy issuance.

What documents are required to purchase Tata AIG car insurance online?

To purchase Tata AIG car insurance online, you will typically need to provide your vehicle’s registration details, driving license, and other relevant information. The exact documents required may vary depending on the policy and your location.

Can I get a quote for Tata AIG car insurance online?

Yes, you can get a quote for Tata AIG car insurance online by visiting the Tata AIG website and filling in the required details. You will receive a quote based on your inputs, which you can use to compare policies and make an informed decision.

How do I renew my Tata AIG car insurance policy online?

To renew your Tata AIG car insurance policy online, visit the Tata AIG website, log in to your account, and follow the renewal process. You will need to provide updated information and make the premium payment to complete the renewal.

What is the claim process for Tata AIG car insurance?

To make a claim on your Tata AIG car insurance policy, you can contact the Tata AIG customer care or visit their website to initiate the claim process. You will need to provide the required documents, and the claim will be processed accordingly.

Does Tata AIG offer cashless claims at network garages?

Yes, Tata AIG offers cashless claims at network garages. You can avail of this facility by getting your vehicle repaired at a Tata AIG network garage, and the insurance company will settle the bill directly with the garage.

Can I customize my Tata AIG car insurance policy with add-on covers?

Yes, you can customize your Tata AIG car insurance policy with add-on covers and riders to enhance your coverage. These add-ons can provide additional protection against specific risks and can be purchased along with your policy.

Reference

https://www.youtube.com/@InsuranceDekho