Are you aware of the hidden threats lurking in the Indian auto insurance landscape? With the rise of insurance fraud, many individuals are unknowingly falling prey to deceitful practices that can lead to significant financial losses.

As you navigate the complex world of car insurance, it’s essential to stay informed about the common scams that can put your hard-earned money at risk. This article will shed light on the top scams to watch out for and provide you with practical tips on how to avoid them, ensuring you make informed decisions and protect your financial well-being.

Common Car Insurance Frauds in India

India is witnessing a surge in car insurance scams, which can have far-reaching consequences for both insurers and the insured. It is crucial for policyholders to be aware of the common types of frauds to avoid falling prey to them.

Fake Insurance Agents and Counterfeit Policies

One of the prevalent scams involves fake insurance agents who sell counterfeit policies to unsuspecting buyers. These agents often mimic legitimate insurance companies, making it difficult for customers to distinguish between genuine and fake policies. To avoid this, it’s essential to verify the authenticity of insurance agents and check if they are registered with the Insurance Regulatory and Development Authority of India (IRDAI).

Inflated Repair Costs and Garage Collusion

Another common scam is the inflation of repair costs, often in collusion with garages. Garage collusion involves garages and fraudsters working together to inflate the cost of repairs, leading to higher insurance claims. Policyholders should be cautious of garages that recommend unnecessary repairs and always get a second opinion.

Staged Accidents and False Claims

Staged accidents are a significant concern, where fraudsters deliberately stage an accident to claim insurance money. These scams can be sophisticated, involving multiple parties. Being aware of the signs of staged accidents, such as inconsistencies in the accident report, can help policyholders avoid being part of such scams.

By being informed and vigilant, car owners in India can protect themselves from these common car insurance scams and ensure a smoother insurance experience.

Recognizing Car Insurance Scams in the Indian Market

With the rise of car insurance scams in India, it’s vital to understand the red flags that indicate a potential scam. Being vigilant can save you from financial loss and ensure you have the right coverage when you need it.

Several tactics are used by scammers to deceive unsuspecting customers. Understanding these can help you steer clear of potential scams.

Too-Good-To-Be-True Premium Offers

One common scam involves offering premiums that are significantly lower than the market average. Fraudsters may lure victims with unrealistically low premiums, only to disappear with the customer’s money or provide fake policies. Always compare rates from different providers and be wary of deals that seem too good to be true.

High-Pressure Sales Tactics

Scammers often use high-pressure sales tactics to push customers into buying fake policies without giving them time to think or verify the authenticity of the offer. Legitimate insurance companies will give you the time and information you need to make an informed decision.

Suspicious Documentation and Verification Issues

Another sign of a potential scam is suspicious documentation. Fake insurance documents may contain errors, lack official stamps, or have other verification issues. Always verify the authenticity of your insurance documents directly with the insurance provider or the Insurance Regulatory and Development Authority of India (IRDAI).

By being aware of these signs and taking the necessary precautions, you can significantly reduce the risk of falling victim to car insurance scams in India.

Effective Strategies to Avoid Car Insurance Scams

With the rise in car insurance scams, adopting effective strategies to avoid falling prey to such frauds has become indispensable. Car owners in India need to be vigilant and informed to protect their financial security.

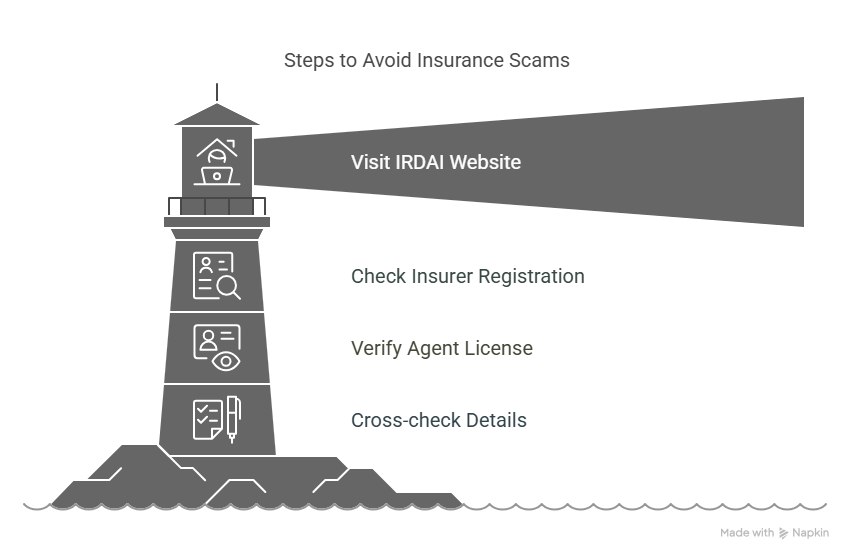

Verifying Insurance Providers with IRDAI

One of the primary steps in avoiding car insurance scams is to verify if the insurance provider is registered with the Insurance Regulatory and Development Authority of India (IRDAI). You can check the IRDAI website for a list of registered insurers. This simple step can save you from dealing with fraudulent insurance agents.

- Visit the IRDAI website to check the registration status of your insurer.

- Ensure the insurance agent provides a valid license number.

- Cross-check the details with the IRDAI database.

Understanding Your Policy Coverage and Terms

It’s crucial to thoroughly understand your car insurance policy coverage and terms. Read the fine print and ask your insurer to clarify any doubts. Knowing what is covered and what isn’t can prevent unpleasant surprises when you file a claim.

- Carefully read the policy document.

- Ask questions if you’re unsure about any terms or conditions.

- Keep a copy of your policy documents for your records.

Digital Tools for Verification and Reporting

In today’s digital age, several online tools and apps can help you verify insurance providers and report scams. For instance, you can use the IRDAI’s insurance repository to check policy details. Additionally, reporting suspicious activities to the appropriate authorities can help curb insurance fraud.

- Utilize online platforms to verify insurance policies.

- Report scams to the IRDAI or local authorities.

- Stay informed about common scams through consumer forums and updates from regulatory bodies.

Conclusion

Being aware of common car insurance scams and knowing how to avoid them is crucial in safeguarding your financial well-being. As discussed, fake insurance agents, inflated repair costs, and staged accidents are some of the prevalent car insurance frauds in India.

To avoid falling prey to such scams, verifying insurance providers with IRDAI, understanding your policy coverage, and utilizing digital tools for verification are effective strategies. By being proactive and vigilant, you can protect yourself from car insurance fraud and ensure a smooth claims process.

Staying informed about how to avoid car insurance scams and being cautious when dealing with insurance providers can significantly reduce the risk of being scammed. By adopting these strategies, you can enjoy a secure and hassle-free car insurance experience.

Reference

https://www.youtube.com/user/bankbazaar