Did you know that approximately 1 in 8 drivers in the United States is uninsured? This staggering statistic highlights the importance of understanding auto insurance requirements and the role of uninsured motorist coverage in protecting you financially in the event of an accident.

When you’re involved in a car accident, the last thing you want to worry about is whether the other driver has insurance. That’s where uninsured motorist coverage comes in – it’s a crucial component of your auto insurance policy that can help cover medical expenses and damages if the other driver is uninsured.

By understanding the uninsured motorist coverage rules, you can make informed decisions about your auto insurance and ensure you’re protected on the road.

Understanding Uninsured Motorist Coverage Rules

Understanding the intricacies of uninsured motorist coverage is crucial for making informed decisions about your insurance policy. Uninsured motorist coverage is designed to protect you in the event of an accident with a driver who does not have insurance.

What Is Uninsured Motorist Coverage?

Uninsured motorist coverage is a type of insurance that kicks in when you’re involved in an accident with someone who doesn’t have insurance. This coverage helps pay for your medical expenses and other damages. It’s essential to review your policy details to understand the extent of your coverage.

The specifics of uninsured motorist coverage can vary significantly depending on state laws. Some states require drivers to have this coverage, while others make it optional.

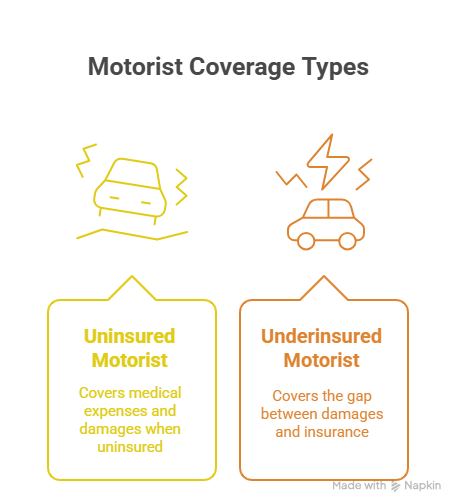

Difference Between Uninsured and Underinsured Coverage

While both types of coverage protect you from drivers who can’t fully cover the damages they cause, there’s a key difference. Uninsured motorist coverage applies when the other driver has no insurance, whereas underinsured motorist coverage kicks in when the other driver’s insurance is insufficient to cover the damages.

| Coverage Type | Trigger | Benefit |

|---|---|---|

| Uninsured Motorist Coverage | No insurance | Covers medical expenses and damages |

| Underinsured Motorist Coverage | Insufficient insurance | Covers the gap between damages and the other driver’s insurance limit |

Understanding these differences is vital for ensuring you have the right coverage. Reviewing your policy details and being aware of state laws regarding these coverages can help you make informed decisions.

State-Specific Requirements and Regulations

Uninsured motorist coverage regulations vary significantly from state to state, making it essential for drivers to be aware of their local laws. This knowledge is crucial for ensuring compliance with state requirements and avoiding potential legal and financial repercussions.

Mandatory vs. Optional Coverage States

One of the critical aspects of uninsured motorist coverage is whether it is mandatory or optional in a given state. Some states require drivers to have this coverage as part of their auto insurance policy, while others leave it as an optional feature. For instance, in states like New Jersey and New York, uninsured motorist coverage is mandatory, providing drivers with a higher level of protection against uninsured drivers.

In contrast, states like New Hampshire and Virginia offer more flexibility, allowing drivers to opt-out of uninsured motorist coverage under certain conditions. Understanding these regulations is vital for drivers to make informed decisions about their auto insurance.

Coverage Limits and Minimum Requirements

Another important consideration is the coverage limits and minimum requirements for uninsured motorist coverage, which also vary by state. Coverage limits refer to the maximum amount an insurance company will pay for a covered claim. States often set minimum coverage limits that drivers must have to comply with state laws.

For example, in California, the minimum coverage limit for uninsured motorist bodily injury coverage is $15,000 per person and $30,000 per accident. Drivers should be aware of these limits to ensure they have adequate liability protection in case of an accident with an uninsured driver.

- Check your state’s minimum coverage requirements.

- Consider purchasing higher coverage limits for better protection.

- Review your policy regularly to ensure compliance with state laws.

Filing and Navigating Uninsured Motorist Claims

When you’re involved in an accident with an uninsured driver, knowing how to file a claim is crucial for getting the compensation you deserve. The process can be complex, but understanding the steps involved can make it more manageable.

Required Documentation and Evidence

To file a successful uninsured motorist claim, you’ll need to gather and submit several key documents. These include:

- Police Report: A copy of the police report filed at the scene of the accident.

- Medical Records: Documentation of your injuries, including medical bills and treatment records.

- Witness Statements: Statements from any witnesses to the accident.

- Proof of Loss: Evidence of your losses, such as repair estimates for your vehicle.

Legal Implications and Time Limitations

It’s essential to understand the legal implications of filing an uninsured motorist claim, including the time limitations involved. The statute of limitations for filing a claim varies by state, so it’s crucial to check your state’s specific laws to avoid missing the deadline.

For example, in some states, you may have as little as one year to file a claim, while in others, you may have up to three years or more.

Working With Insurance Adjusters

When working with insurance adjusters, it’s vital to be prepared and knowledgeable about the process. Here are some tips to help you navigate the negotiation:

- Be Prepared: Have all your documentation ready and organized.

- Understand Your Policy: Know what your insurance policy covers and what you’re entitled to.

- Negotiate Fairly: Be prepared to negotiate, and don’t be afraid to advocate for yourself.

By following these steps and understanding the process, you can ensure a fair settlement for your uninsured motorist claim.

Conclusion

Understanding uninsured motorist coverage rules is crucial for drivers to safeguard their financial well-being in the event of an accident. By grasping the differences between uninsured and underinsured coverage, state-specific requirements, and the process of filing claims, individuals can make informed decisions about their insurance policies.

Reviewing your current insurance policy and adjusting your coverage as needed can provide peace of mind and financial protection. Uninsured motorist coverage rules vary by state, so it’s essential to familiarize yourself with the specific regulations in your area. By doing so, you can ensure you’re adequately protected against financial loss in the event of an accident with an uninsured or underinsured driver.

Stay informed, stay protected. Knowing uninsured motorist coverage rules can make all the difference in navigating the complexities of insurance claims and securing the compensation you deserve.

FAQ

What is uninsured motorist coverage, and do I need it?

Uninsured motorist coverage is a type of auto insurance that protects you if you’re involved in an accident with a driver who doesn’t have insurance. It’s essential to have this coverage to avoid financial losses in such situations. Check your state’s laws to see if it’s mandatory or optional.

How does uninsured motorist coverage differ from underinsured motorist coverage?

Uninsured motorist coverage applies when the other driver has no insurance, while underinsured motorist coverage kicks in when the other driver’s insurance is insufficient to cover the damages. Both types of coverage can be crucial in protecting you financially.

What are the state-specific requirements for uninsured motorist coverage?

Requirements for uninsured motorist coverage vary by state. Some states make it mandatory, while others make it optional. It’s crucial to check your state’s laws to understand your obligations and ensure you’re adequately covered.

What are the minimum coverage limits for uninsured motorist coverage, and how do they vary?

Minimum coverage limits for uninsured motorist coverage differ by state. It’s essential to understand these limits to ensure you have enough coverage to protect yourself in case of an accident.

What documentation and evidence do I need to file an uninsured motorist claim?

To file an uninsured motorist claim, you’ll typically need to provide documentation such as police reports, medical bills, and proof of the other driver’s lack of insurance. Keeping detailed records can help support your claim.

What are the time limitations for filing an uninsured motorist claim?

Time limitations for filing an uninsured motorist claim vary by state and insurance policy. It’s crucial to check your policy and state laws to understand the deadlines and avoid missing them.

How do I work effectively with insurance adjusters when filing an uninsured motorist claim?

To work effectively with insurance adjusters, keep detailed records, be prepared to negotiate, and understand your policy. This can help ensure a fair settlement and a smooth claims process.

Can I have both uninsured and underinsured motorist coverage in my auto insurance policy?

Yes, you can typically have both uninsured and underinsured motorist coverage as part of your auto insurance policy. This can provide comprehensive protection against financial losses in case of an accident with an uninsured or underinsured driver.

How can I review and adjust my current insurance policy to ensure I have adequate uninsured motorist coverage?

Reviewing your insurance policy involves checking your coverage limits, understanding your state’s laws, and assessing your financial situation. You can adjust your policy as needed to ensure you have adequate protection.