Did you know that nearly 55% of Indian car owners do not have comprehensive car insurance? This staggering statistic highlights a significant gap in the awareness and understanding of the importance of comprehensive vehicle protection. Full cover car insurance provides extensive coverage against various risks, including accidents, theft, and natural disasters.

Understanding the cost of such insurance is crucial for making informed decisions. The cost is influenced by several factors, including the type of vehicle, driver’s history, and location.

As a car owner in India, it’s essential to compare different insurance options to find the best car insurance cost comparison. In the following sections, we will delve deeper into the factors affecting the full cover insurance for car price and provide insights to help you make the right choice.

Understanding Full Cover Insurance for Car Price in India

Understanding the intricacies of full cover car insurance is crucial for making informed decisions about your vehicle’s protection. Full cover car insurance is more than just a legal requirement; it’s a safeguard against various risks associated with owning and driving a vehicle.

What Does Full Cover Car Insurance Include?

Full cover car insurance in India typically includes coverage for damages to your vehicle, third-party liabilities, and personal accident cover. It provides financial protection against theft, natural disasters, and accidents, ensuring that you’re not burdened with hefty repair costs or legal liabilities.

Key components of full cover car insurance:

- Own damage cover

- Third-party liability cover

- Personal accident cover

Average Cost of Comprehensive Car Insurance in India

The average cost of comprehensive car insurance in India varies based on several factors, including the type of vehicle, its age, and the location. Generally, the premium can range from 2% to 5% of the vehicle’s insured value.

Price Ranges by Car Segments

Insurance premiums differ across various car segments. Here’s a simplified overview:

| Car Segment | Average Premium Range |

|---|---|

| Hatchback | ₹8,000 – ₹12,000 |

| Sedan | ₹10,000 – ₹15,000 |

| SUV | ₹12,000 – ₹18,000 |

Regional Variations in Insurance Costs

Insurance costs also vary by region due to factors like traffic density, crime rates, and local regulations. For instance, metropolitan cities tend to have higher premiums compared to smaller towns.

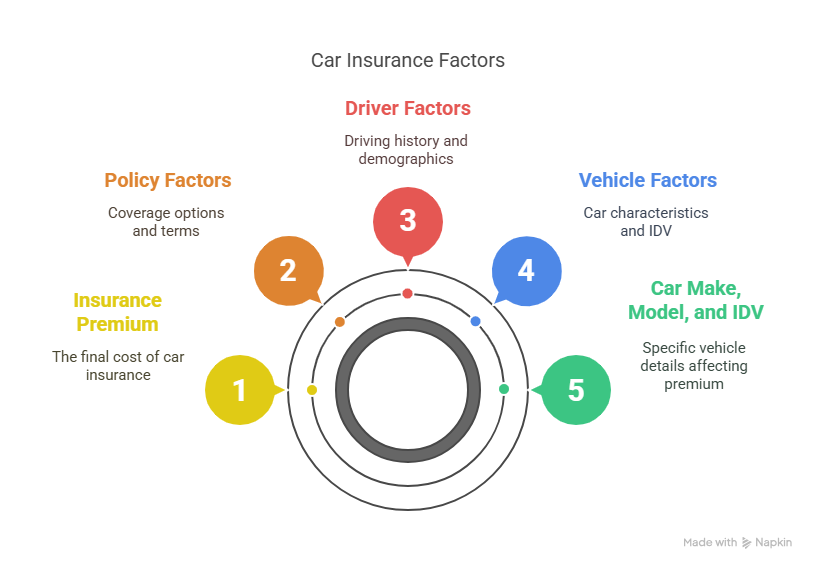

Factors Affecting Full Coverage Car Insurance Rates

Full coverage car insurance rates in India are affected by a variety of factors, including those related to the vehicle, driver, and policy. Understanding these factors is crucial for car owners to make informed decisions and minimize their insurance expenses.

Vehicle-Related Factors

The characteristics of your vehicle play a significant role in determining your insurance premium. Two key aspects are considered: the car’s make, model, and IDV, and the vehicle’s age along with any modifications made.

Car Make, Model and IDV

The make and model of your car, along with its Insured Declared Value (IDV), significantly impact your insurance premium. Luxury cars or models with high IDV attract higher premiums due to the increased cost of repairs or replacement. IDV is a critical factor as it directly influences the premium amount; a higher IDV means a higher premium.

Vehicle Age and Modifications

The age of your vehicle and any modifications made to it also affect your insurance rates. Older vehicles typically have lower premiums because their value decreases over time. However, modifications can increase premiums as they may enhance the vehicle’s performance or value, making it riskier or more expensive to insure.

Driver-Related Factors

The profile of the driver is another crucial determinant of insurance premiums. Factors such as driving history, no-claim bonus, age, and experience of the driver are taken into account.

Driving History and No-Claim Bonus

A clean driving history and a no-claim bonus can significantly reduce your insurance premium. Insurers view drivers with a good history as less risky, offering them discounts on their premiums. The no-claim bonus is a reward for not making any claims during the policy period, and it can lead to substantial savings.

Age and Experience of Driver

The age and experience of the driver are also important factors. Generally, more experienced drivers are considered less risky and are offered lower premiums. Younger or less experienced drivers, on the other hand, may face higher premiums due to the higher risk associated with them.

Policy-Related Factors

The specifics of your insurance policy also play a role in determining your premium. Two key aspects are the deductible amount and any add-on coverages or riders.

Deductible Amount

The deductible is the amount you agree to pay out of pocket in the event of a claim. A higher deductible can lower your premium because it reduces the insurer’s liability. However, it’s essential to choose a deductible amount that you can afford to pay.

Add-on Coverages and Riders

Add-on coverages and riders provide additional protection but at an extra cost. While they enhance your policy, they also increase your premium. It’s crucial to weigh the benefits against the costs and choose add-ons that are relevant to your needs.

| Factor | Description | Impact on Premium |

|---|---|---|

| Car Make and Model | Luxury or high-value cars | Higher Premium |

| IDV | Higher IDV | Higher Premium |

| Vehicle Age | Older vehicles | Lower Premium |

| Modifications | Performance or value-enhancing modifications | Higher Premium |

| Driving History | Clean driving history | Lower Premium |

| No-Claim Bonus | Presence of NCB | Lower Premium |

| Age and Experience | More experienced drivers | Lower Premium |

| Deductible Amount | Higher deductible | Lower Premium |

| Add-on Coverages | Additional coverages or riders | Higher Premium |

Conclusion: Finding Affordable Full Cover Car Insurance in India

Finding the right full cover car insurance in India can be a daunting task, but by understanding the factors that influence insurance premiums, car owners can make informed decisions. The key is to compare quotes from various insurance providers using tools like car insurance premium calculators to get the best full coverage auto insurance rates.

When searching for full cover insurance for car price, it’s essential to consider vehicle-related factors, driver-related factors, and policy-related factors that impact insurance costs. By doing so, car owners can choose a policy that offers the best value for money.

A car insurance cost comparison is crucial in identifying the most affordable options. Insurance companies like HDFC ERGO, ICICI Lombard, and Bajaj Allianz offer competitive rates, but it’s vital to evaluate their policies and choose the one that suits your needs.

Ultimately, securing the best full coverage auto insurance rates requires research, comparison, and a thorough understanding of the factors that affect insurance premiums. By being informed, car owners in India can drive away with confidence, knowing they have the right coverage at the right price.

Reference

https://www.qikinsurance.com/what-is-car-insurance