In India, over 4.5 lakh road accidents occur every year, resulting in significant financial losses for individuals and families. With the rising number of vehicles on the road, having the right car insurance coverage for claims is crucial to mitigate these losses.

Choosing the top-rated car insurance for claims experience can be a daunting task, given the numerous insurance providers available in the market. Our 2025 review aims to simplify this process by highlighting the key factors that influence the claims process and showcasing the top insurance providers that excel in this area.

By the end of this article, you will be equipped with the knowledge to select the best car insurance coverage for claims that suits your needs, ensuring a seamless and hassle-free claims experience.

What Makes a Great Car Insurance for Claims Processing

A seamless claims experience is crucial for car owners in India, and the right insurance provider can make all the difference. When evaluating car insurance, it’s essential to consider the claims processing capabilities to ensure a smooth experience.

Key Factors That Determine Claims Experience

The claim settlement ratio, turnaround time, and digital claim processing capabilities are key factors that determine a positive claims experience. A high claim settlement ratio indicates a higher likelihood of claims being settled, while a faster turnaround time ensures that policyholders receive their claim amounts quickly.

Common Challenges in Car Insurance Claims in India

Despite the advancements in car insurance, policyholders in India often face challenges such as delays in claim settlement, documentation issues, and lack of transparency. Understanding these challenges can help insurance providers improve their services and offer better claim handling.

Which Car Insurance Is Best for Claims in India

For many car owners in India, the true test of a car insurance provider lies in its ability to settle claims quickly and fairly. When evaluating car insurance companies, it’s essential to look beyond just the premium costs and consider their claims reputation.

A key metric in assessing this reputation is the Claim Settlement Ratio (CSR), which indicates the percentage of claims settled by an insurer.

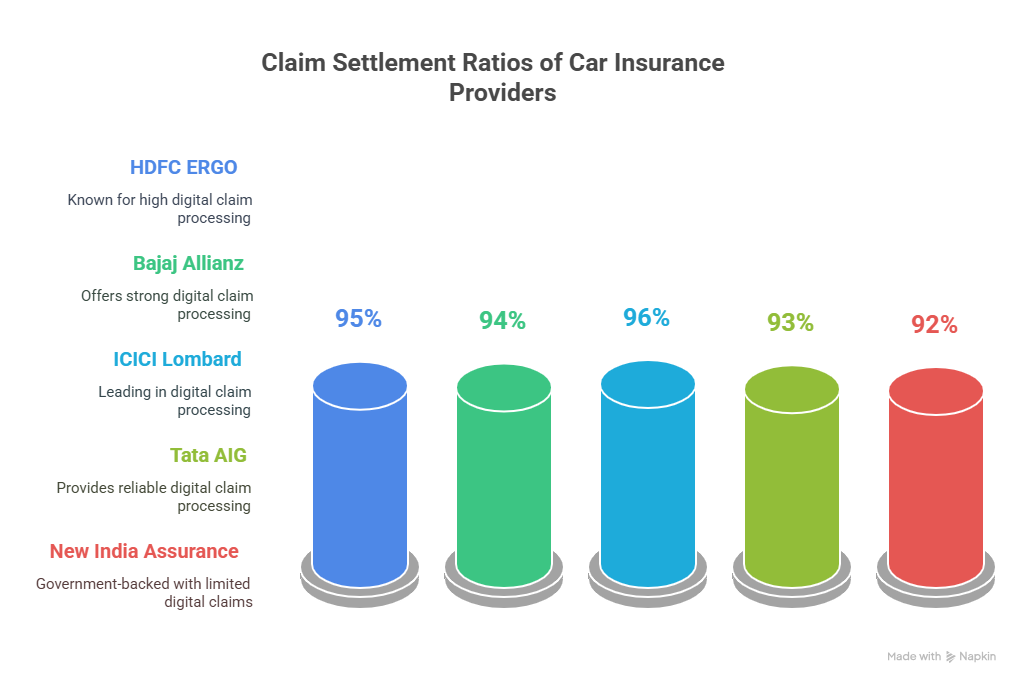

Claim Settlement Ratio Comparison

The Claim Settlement Ratio is a critical indicator of an insurer’s reliability. Here’s a comparison of the CSR among top car insurance providers in India:

| Insurance Provider | Claim Settlement Ratio (%) |

|---|---|

| HDFC ERGO | 95 |

| Bajaj Allianz | 92 |

| ICICI Lombard | 96 |

Insurers like ICICI Lombard and HDFC ERGO stand out with high CSR, indicating a strong commitment to settling claims.

Turnaround Time for Claim Resolution

Another crucial aspect is the turnaround time for claim resolution. To find the right car insurance for claims, one must consider how quickly insurers process claims.

- Quick Claim Processing: Some insurers offer fast-track claim processing, significantly reducing the waiting time.

- Digital Processing: The use of digital platforms has streamlined the claims process, making it faster and more efficient.

Digital Claim Processing Capabilities

The ability to process claims digitally is becoming increasingly important. Car insurance companies with highest claim satisfaction often have robust digital claim processing systems in place.

These systems not only enhance customer experience but also reduce the time taken to settle claims. When choosing a car insurance provider, it’s worth considering those that offer seamless digital claim processing.

Top Car Insurance Providers for Claims in India (2025)

The best car insurance providers in India are those that not only offer comprehensive coverage but also excel in claims settlement. When selecting a car insurance provider, it’s crucial to consider their claims handling performance, customer service, and overall reputation.

HDFC ERGO General Insurance

HDFC ERGO is known for its efficient claims processing and customer-centric approach. With a claim settlement ratio of over 95%, it stands out among its peers. Quick claim settlement and a wide range of coverage options make it a preferred choice for many.

Bajaj Allianz General Insurance

Bajaj Allianz offers robust car insurance policies with a focus on fast and fair claims settlement. Their digital claim processing capabilities enhance the customer experience, making it a top choice for tech-savvy individuals.

ICICI Lombard General Insurance

ICICI Lombard is recognized for its comprehensive car insurance coverage and efficient claims handling. With a strong network and 24/7 customer support, it ensures a smooth claims process for its policyholders.

Tata AIG General Insurance

Tata AIG provides a range of car insurance policies tailored to different needs, with a focus on quick claims settlement. Their customer-friendly approach and wide coverage options make them a popular choice.

New India Assurance

New India Assurance, a government-backed insurer, is known for its reliability and trustworthiness. It offers competitive car insurance policies with a strong claims settlement record, making it a viable option for many.

| Insurance Provider | Claim Settlement Ratio | Digital Claim Processing |

|---|---|---|

| HDFC ERGO | 95% | Yes |

| Bajaj Allianz | 94% | Yes |

| ICICI Lombard | 96% | Yes |

| Tata AIG | 93% | Yes |

| New India Assurance | 92% | Limited |

When choosing a car insurance provider, it’s essential to evaluate their claims handling capabilities, customer service, and coverage options. By considering these factors, you can make an informed decision about which car insurance is best for claims in India.

Conclusion

Selecting the best car insurance for claims in India is crucial for a stress-free experience. By considering factors like claim settlement ratio, turnaround time, and digital claim processing capabilities, you can make an informed decision. Top-rated car insurance providers like HDFC ERGO, Bajaj Allianz, and ICICI Lombard offer excellent claims services, making them worth considering.

When comparing car insurance for claim service, it’s essential to evaluate the claim settlement ratio and turnaround time. Car insurance companies with the highest claim satisfaction, such as Tata AIG and New India Assurance, demonstrate a commitment to customer satisfaction. By choosing a reputable insurer, you can ensure a smooth claims process.

Ultimately, the right car insurance can provide peace of mind and financial protection. Compare top-rated car insurance options and select a provider that meets your needs, offering a hassle-free claims experience.

FAQ

What is the claim settlement ratio, and why is it important?

The claim settlement ratio is the percentage of claims settled by an insurance provider out of the total claims received. It’s a crucial metric as it indicates the provider’s ability to honor claims, giving policyholders confidence in their insurance coverage.

How do I compare car insurance for claim service?

To compare car insurance for claim service, look at the claim settlement ratio, turnaround time, and digital claim processing capabilities of different providers. You can also check reviews and ratings from existing customers to get an idea of their claims experience.

Which car insurance companies have the highest claim satisfaction ratings?

Some of the top car insurance companies with high claim satisfaction ratings in India include HDFC ERGO General Insurance, Bajaj Allianz General Insurance, and ICICI Lombard General Insurance, known for their efficient claims processing and customer service.

What are the common challenges faced when filing a car insurance claim in India?

Common challenges include delays in claim processing, documentation issues, and lack of transparency. However, many insurance providers are now adopting digital claim processing to mitigate these issues and improve the overall claims experience.

How can I find the right car insurance for claims?

To find the right car insurance for claims, consider factors such as claim settlement ratio, turnaround time, and digital claim processing capabilities. Research and compare different insurance providers, and read reviews from existing customers to make an informed decision.

What is the importance of digital claim processing in car insurance?

Digital claim processing is becoming increasingly important as it enables faster and more efficient claim settlement. It reduces the need for physical documentation and allows policyholders to track their claims online, making the overall experience more convenient.

Can I get an idea of the best auto insurance for claims process by looking at the insurance provider’s reputation?

Yes, an insurance provider’s reputation can give you an idea of their claims process. Look for providers with a strong reputation for honoring claims and providing good customer service, as they are more likely to offer a smooth claims experience.

Are there any car insurance providers that stand out for their claims handling?

Yes, providers like HDFC ERGO General Insurance, Bajaj Allianz General Insurance, and ICICI Lombard General Insurance are known for their efficient claims handling and high claim settlement ratios, making them stand out in the Indian car insurance market.

Reference

https://www.youtube.com/user/PolicyBazaar

https://www.youtube.com/user/bankbazaar

https://www.qikinsurance.com/car-insurance-for-electric-vehicles