With over 300 million registered vehicles on Indian roads, the importance of having the right car insurance cannot be overstated. A recent survey revealed that nearly 70% of Indian car owners do not compare different insurance policies before making a purchase, potentially leading to missed savings and inadequate coverage.

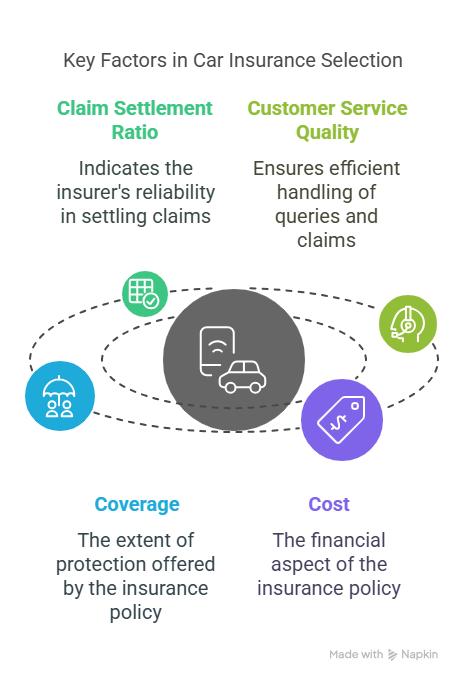

Choosing the right car insurance policy can be a daunting task, given the numerous options available in the Indian market. Factors such as coverage, premium, claim settlement ratio, and customer service play a crucial role in determining the best insurance provider for your needs.

To make an informed decision, it’s essential to compare different insurance providers and understand their offerings. In this article, we will provide a detailed comparison of various car insurance policies available in India, helping you make a well-informed choice.

Key Factors to Consider When Choosing Car Insurance in India

With multiple car insurance providers in India, understanding the key factors is essential for making the right choice. When you compare car insurance in India, several aspects come into play to ensure you select the best policy for your needs.

To begin with, it’s crucial to understand the different types of car insurance policies available. This includes third-party liability insurance, which is mandatory, and comprehensive insurance, which offers broader coverage including damages to your vehicle.

Types of Car Insurance Policies Available

Car insurance policies in India primarily come in two forms: Third-party liability insurance and comprehensive insurance. Third-party insurance covers damages to others in case of an accident, while comprehensive insurance also covers damages to your vehicle. Understanding these options is vital when you compare car insurance in India.

Coverage Benefits and Add-on Options

Different insurance companies offer various coverage benefits and add-on options. These can include zero depreciation cover, roadside assistance, and personal accident cover, among others. When evaluating top car insurance companies in India, it’s essential to look at these additional benefits.

Claim Settlement Ratio and Customer Service

The claim settlement ratio and quality of customer service are critical factors. A higher claim settlement ratio indicates that more claims are being settled, reflecting the insurer’s reliability. Similarly, good customer service ensures that your queries and claims are handled efficiently.

By considering these factors, you can make an informed decision when choosing car insurance in India. It’s about finding the right balance between coverage, cost, and service quality.

Which Car Insurance is Better in India: Comprehensive Provider Comparison

To find the best car insurance in India, it’s essential to compare the offerings of different providers. The Indian car insurance market is segmented into public sector insurance companies, private sector insurance leaders, and digital-first insurance options, each with its unique strengths and weaknesses.

Public Sector Insurance Companies

Public sector insurance companies have a long-standing reputation in India. Companies like New India Assurance and Oriental Insurance offer comprehensive car insurance policies with extensive coverage options.

New India Assurance and Oriental Insurance

New India Assurance is one of the largest public sector insurers, known for its wide range of coverage options and extensive network. Oriental Insurance also offers robust car insurance policies with various add-on options.

Private Sector Insurance Leaders

Private sector insurance leaders have revolutionized the car insurance landscape with innovative policies and customer-centric services. Companies like HDFC ERGO, ICICI Lombard, and Bajaj Allianz are at the forefront.

HDFC ERGO, ICICI Lombard, and Bajaj Allianz

HDFC ERGO is known for its comprehensive coverage and excellent customer service. ICICI Lombard offers a range of car insurance policies with customizable options. Bajaj Allianz provides innovative insurance solutions with a strong online presence.

Digital-First Insurance Options

The rise of digital-first insurance options has transformed the way car insurance is bought and managed. Companies like Acko, Digit, and Go Digit offer seamless online experiences and competitive pricing.

Acko, Digit, and Go Digit

Acko is known for its user-friendly online platform and quick claim processing. Digit offers affordable car insurance with a focus on digital convenience. Go Digit provides comprehensive coverage with a tech-savvy approach.

By comparing these different categories of car insurance providers, individuals can make informed decisions based on their specific needs and preferences, ensuring they find the affordable car insurance in India that suits them best.

Conclusion: Making the Right Choice for Your Needs

Choosing the right car insurance in India can be a daunting task, given the numerous options available. By considering key factors such as coverage benefits, claim settlement ratio, customer service, and car insurance rates in India, you can make an informed decision that suits your specific needs and budget.

Reading car insurance reviews in India can provide valuable insights into the experiences of other customers, helping you gauge the reliability and service quality of insurance providers. By weighing these factors and doing your research, you can select a car insurance policy that offers the right balance of protection and affordability.

Ultimately, the best car insurance is one that meets your individual requirements, providing you with peace of mind on the road. Take the time to compare different insurance options, and don’t hesitate to seek advice if needed, to ensure you make the most suitable choice for your vehicle and financial situation.

Reference

https://www.youtube.com/@MyInsuranceClub